CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

When Life Throws Curves: Why Disability Insurance is Your Safety Net

Discover how disability insurance can be your ultimate safety net when life takes unexpected turns. Secure your future today!

Understanding Disability Insurance: How it Protects Your Financial Future

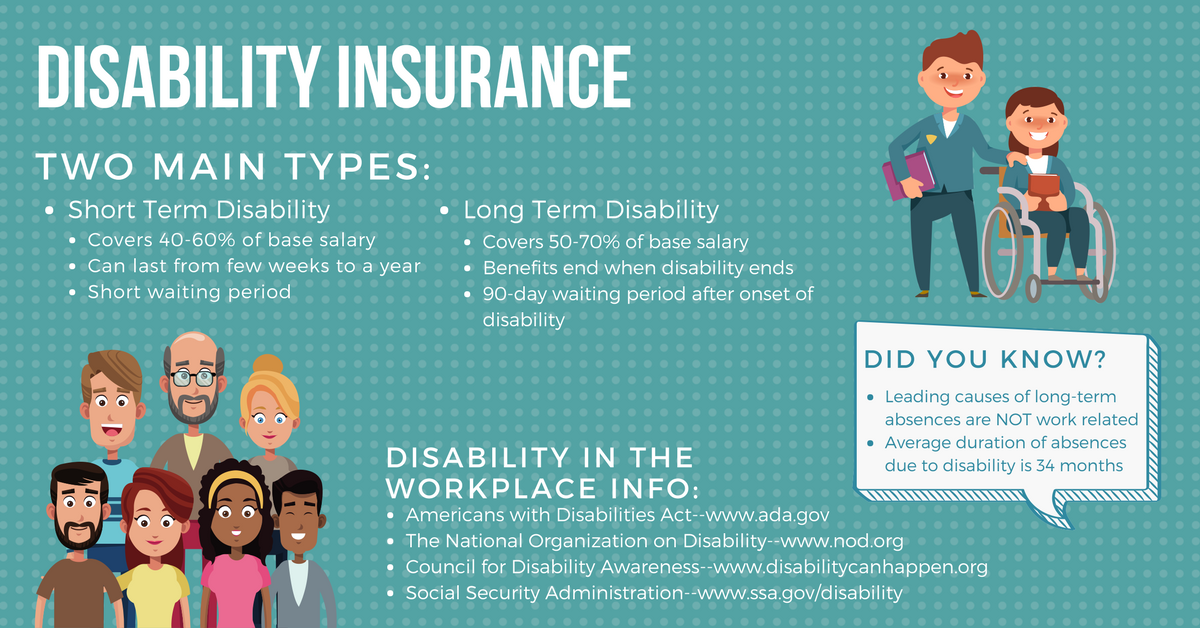

Understanding disability insurance is crucial for safeguarding your financial future. This type of insurance provides income replacement if you become unable to work due to a qualifying medical condition or disability. It acts as a safety net, ensuring that you can maintain your living standards while focusing on recovery. With the rising prevalence of unexpected health issues, having a robust disability insurance plan in place is more important than ever. It not only covers essential expenses, such as housing and groceries, but also helps alleviate the stress of financial uncertainty during challenging times.

There are various types of disability insurance, including short-term and long-term policies, each designed to meet different needs. Short-term disability insurance typically offers income replacement for up to six months, while long-term disability insurance can extend benefits for several years or even until retirement age. Understanding the differences and selecting the right policy based on your personal circumstances is key to effectively protecting your financial future. By investing in a comprehensive disability insurance plan, you ensure that you and your family are prepared for the unexpected, securing peace of mind when it matters most.

The Importance of Disability Insurance: A Safety Net for Life's Unexpected Challenges

In today's unpredictable world, disability insurance serves as a vital safety net that protects individuals against life's unforeseen challenges. Whether due to an accident, illness, or any event that may hinder your ability to work, having this form of insurance ensures that you can maintain a semblance of financial stability. Without it, individuals may face crippling debt or an inability to cover essential expenses, leading to increased stress and anxiety during already difficult times.

Moreover, disability insurance not only provides income replacement but also empowers individuals to focus on their recovery without the added burden of financial strain. According to various studies, approximately 1 in 4 individuals may experience a disability at some point in their career, underscoring the need for proactive financial planning. Investing in disability insurance is, therefore, not just a wise decision but a crucial measure to safeguard your future and your family’s well-being.

Is Disability Insurance Worth It? Top Questions Answered

When considering whether disability insurance is worth it, it’s essential to evaluate your personal and financial situation. Disability insurance provides income replacement if you are unable to work due to an illness or injury, ensuring you can maintain your standard of living. Is disability insurance worth it? Many experts argue that for anyone who relies on their income, having this type of coverage is crucial. Without it, you could face financial hardships during a time of crisis.

Moreover, understanding the different types of disability insurance is vital. Here are some key points to consider:

- Short-term disability insurance typically covers a portion of your income for a limited time, usually up to six months.

- Long-term disability insurance can provide income replacement for several years or until retirement, depending on the policy.

- Evaluate factors such as your savings, your family's financial situation, and your job stability when deciding if this insurance is necessary for you.