CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

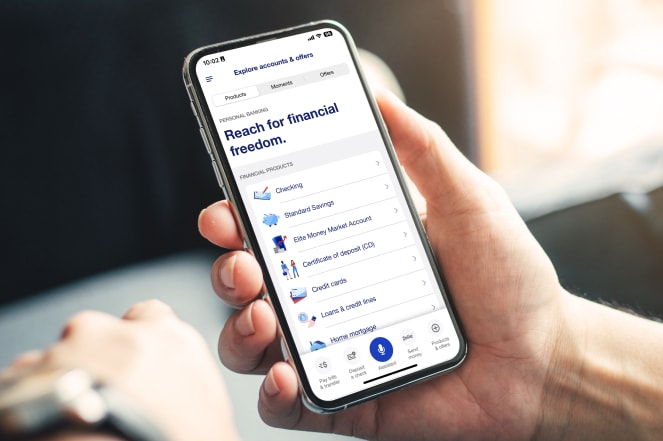

Is Your Bank Killing Your Savings? Find Out!

Discover shocking truths about banks that could be draining your savings! Learn how to protect your hard-earned money today!

The Hidden Fees Eating Away Your Savings: What You Need to Know

When managing your finances, it's essential to be aware of hidden fees that can gradually erode your savings. These fees can come from various sources such as bank accounts, credit cards, and even subscription services. For instance, monthly maintenance fees on checking accounts may seem trivial, but over time, they can add up significantly. Additionally, some credit cards charge annual fees or late payment charges, which can quickly negate any rewards you might earn. It's vital to scrutinize the fine print and understand all potential costs associated with your financial products.

Another common area where you might encounter hidden fees is in investment accounts. Brokers may charge transaction fees or management fees that are not immediately obvious. Furthermore, mutual funds often have expense ratios that could eat into your returns without you even realizing it. To minimize the impact of these hidden costs, consider the following steps:

- Always read the full disclosure documents before signing up for any financial product.

- Shop around for accounts and services with lower or no fees.

- Regularly review your bank and investment statements to identify any unexpected charges.

Are High Interest Rates Hurting Your Savings? Discover the Truth

In today's economic environment, many savers are left wondering, are high interest rates hurting your savings? While higher interest rates typically benefit savers by providing better returns on savings accounts and fixed deposits, the reality is more nuanced. With inflation rates often outpacing interest rates, the real value of your savings could be diminishing even as your interest earnings increase. This situation leads to a paradox where savers feel discouraged, as their hard-earned money struggles to keep up with the rising cost of living.

Moreover, many banks and financial institutions might not pass on the full benefits of increased rates to consumers. Instead, they may offer lower savings account interest rates compared to the benchmark rates set by central banks. Therefore, it’s crucial to shop around and find accounts that offer competitive rates. Remember that assessing whether high interest rates are truly a boon or bane for your savings involves understanding both the nominal interest rates offered and the impact of inflation. Stay informed and proactive to ensure your savings work as hard as you do.

5 Questions to Ask Your Bank to Protect Your Savings

When it comes to protecting your savings, asking the right questions can make all the difference. Begin by inquiring about the FDIC insurance coverage your bank offers. This insurance protects your deposits in case of bank failure, but it’s crucial to know the limits. Additionally, consider asking about the bank's history and financial stability, as understanding their performance can give you insights into the safety of your funds.

Another key question is regarding the bank's policies on security measures. Ask about their fraud detection systems and how they protect your personal information. Don't forget to inquire about their interest rates and any fees that might erode your savings over time. Lastly, find out what options are available for reducing risks, such as setting up alerts for unusual transactions, which can help you stay informed about your account activity.