CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Insurance Showdown: Finding Your Perfect Match

Unlock the secrets to choosing the right insurance! Discover tips and tricks in our showdown to find your perfect match today!

5 Key Factors to Consider When Choosing the Right Insurance Policy

Choosing the right insurance policy is crucial for ensuring that you are adequately protected against unforeseen events. Here are 5 key factors to consider when making your decision:

- Coverage Needs: Assess your specific needs based on your lifestyle, assets, and potential risks. Different policies offer varying levels of coverage, so it's essential to choose one that aligns with your unique circumstances.

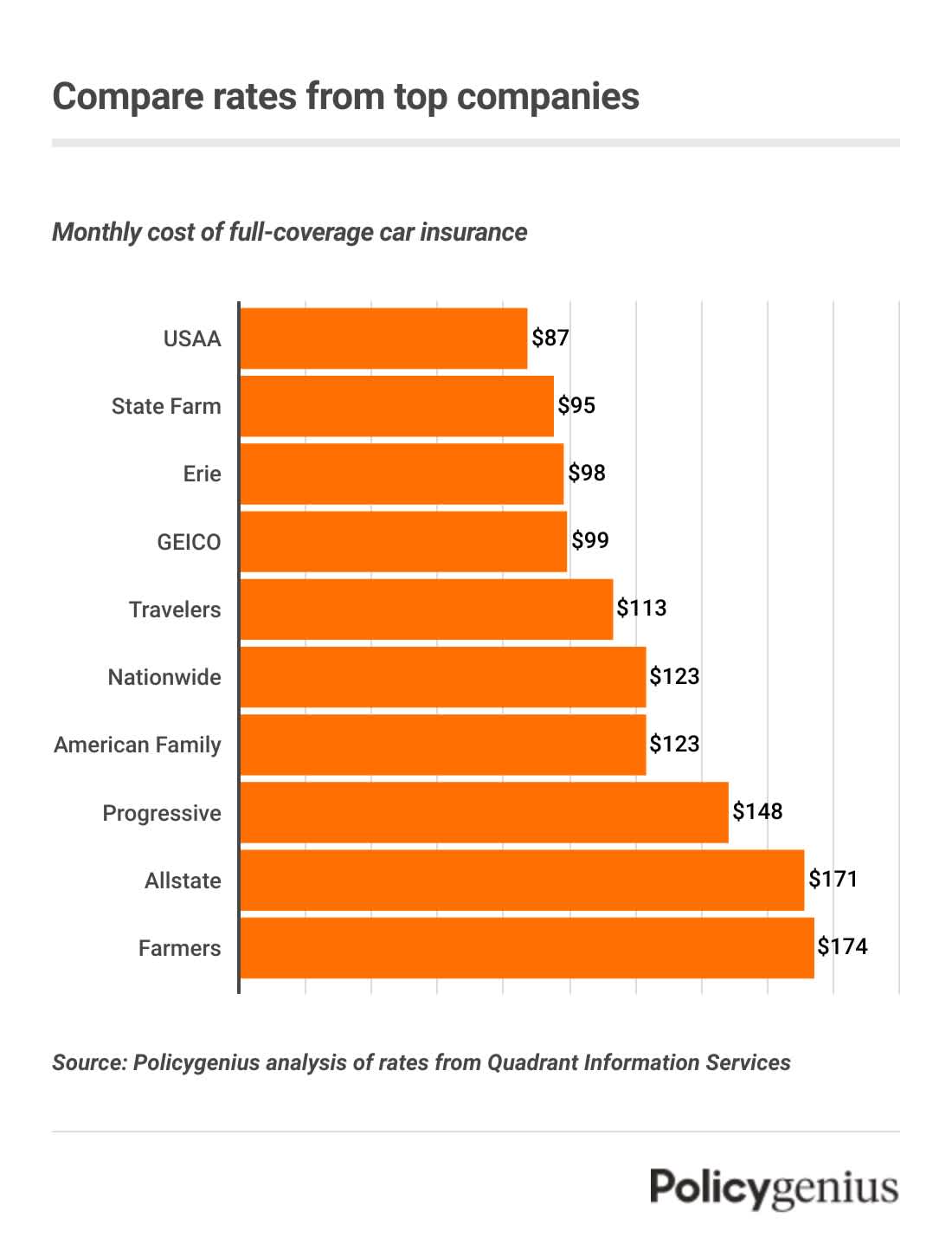

- Premium Costs: Compare premium costs across different insurance providers. While the lowest price may seem appealing, ensure that you are not sacrificing necessary coverage for savings.

Additionally, consider the deductibles you are comfortable with. A higher deductible often means lower premiums, but it also requires you to pay more out-of-pocket in the event of a claim. Furthermore, check the insurance provider's reputation; read reviews and consult ratings to find a trustworthy company known for good customer service. Finally, never shy away from asking questions; clarity is vital in understanding the fine print and avoiding hidden clauses.

The Ultimate Guide to Comparing Insurance Options: What You Need to Know

When it comes to comparing insurance options, understanding the various types of coverage available is crucial. Start by identifying your needs—whether it's health, auto, home, or life insurance. Each category has its own unique features, coverage levels, and pricing structures. To make an informed choice, consider creating a comparison table that outlines the key elements of each policy you are looking at. This table can include premium costs, deductible amounts, coverage limits, and exclusions. The clearer your comparisons, the easier it will be to see which policy aligns best with your requirements.

Another critical step in the insurance comparison process is to evaluate the reputation and customer service of the providers you are considering. Look for customer reviews, ratings, and the financial stability of the insurance companies. You might also want to ask friends or family for their recommendations. Remember, the cheapest option isn’t always the best; it’s essential to weigh the overall value of the coverage against the cost. Use the insights gathered to make a well-rounded decision that safeguards your financial future and meets your unique needs.

Is Your Insurance Coverage Enough? Common Mistakes to Avoid

When assessing whether your insurance coverage is sufficient, it’s crucial to avoid common pitfalls that can leave you financially vulnerable. One of the most frequent mistakes people make is underestimating the value of their assets. Ensure you conduct an accurate assessment of your property, from your home to your personal belongings. You can create a list to evaluate:

- Home value

- Automobiles

- Jewelry and art

- Savings and investments

A comprehensive evaluation helps you determine the right amount of coverage to secure your financial future.

Another common error is overlooking liability limits in your policy. Many individuals focus on property coverage while ignoring the potential costs of legal claims against them. It’s essential to review your policy and consider increasing your liability limits to protect against any unforeseen incidents. Additionally, reaching out to an insurance agent can provide you with valuable insights on the options available to you. Remember, being underinsured could lead to catastrophic financial repercussions in the event of a claim.