CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

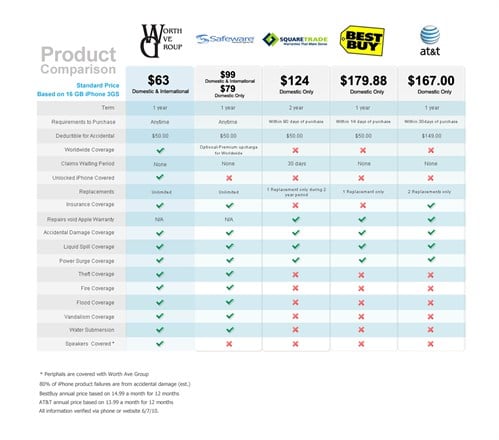

Insurance Showdown: Finding Your Best Policy Match

Discover the ultimate guide to insurance! Unlock the secrets to finding your perfect policy match and save big today!

Top 5 Tips for Comparing Insurance Policies Effectively

Comparing insurance policies can be daunting, but by following a few strategic steps, you can simplify the process and make informed decisions. Tip 1: Start by identifying your coverage needs. Consider factors like the type of insurance you need—be it health, auto, or home insurance—and determine the level of coverage that best fits your lifestyle and financial situation. Tip 2: Gather quotes from multiple providers. It's essential to shop around, as different insurers may offer varying rates and coverage options for similar policies. Use online comparison tools or consult with an insurance broker to streamline this process.

Next, Tip 3: carefully evaluate the details of each policy. Look beyond the premium costs; assess factors such as deductibles, exclusions, and limitations that may affect your claims. Tip 4: Consider the financial stability and customer service reputation of each insurance company. Read reviews and check ratings to ensure you're choosing a reliable insurer. Finally, Tip 5: don’t hesitate to ask questions and clarify any doubts before making a decision. Understanding the finer aspects of your policy is crucial for ensuring the coverage meets your needs and provides peace of mind.

What to Look for in an Insurance Policy: A Comprehensive Guide

When searching for an insurance policy, it is essential to consider several key factors to ensure you choose the best coverage for your needs. First, evaluate the coverage limits; these represent the maximum amount your insurance company will pay for a claim. A policy with higher limits provides better financial protection but may also have a higher premium. Second, examine the deductibles—the amount you must pay out of pocket before the insurance kicks in. Generally, a higher deductible means lower premiums, but it also means more upfront costs during a claim. Finally, pay attention to the exclusions in the policy, as these are specific situations or conditions that are not covered. Understanding these exclusions will help you avoid unexpected surprises in the event of a loss.

Another crucial aspect to consider is the insurer's reputation. Look for customer reviews and ratings to gauge their service quality, particularly regarding claims handling. A good insurer should have a solid track record of prompt and fair claim processing. Additionally, investigate the policy terms, including how often you can adjust coverage or payment plans, as flexibility can be beneficial in changing circumstances. Lastly, it’s wise to consult with an insurance agent or financial advisor to help you navigate the complexities of different policies and find one that meets your specific needs. Taking the time to thoroughly assess these elements will empower you to make an informed decision in your insurance policy selection.

Insurance Myths Debunked: What You Really Need to Know

When it comes to insurance, misinformation can lead to costly misconceptions. One of the most prevalent **insurance myths** is the belief that all insurance policies are the same. In reality, policies vary widely based on factors such as coverage limits, deductibles, and exclusions. Understanding the specific terms of your policy is essential to ensure you're adequately protected. Always read the fine print and ask your insurance agent about any unclear clauses to avoid surprises during a claim.

Another common myth is that having insurance means you won’t have to pay anything out-of-pocket when a claim arises. This belief overlooks the importance of **deductibles** and copayments that policyholders are responsible for. Additionally, some individuals think that once they have insurance, they are entirely covered for all eventualities. However, every policy has limitations and exclusions, meaning it’s crucial to review your coverage regularly and keep up with any changes in your life that may require you to adjust your policy.