CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Insurance Policies: The Safety Net You've Been Ignoring

Discover the key to peace of mind! Uncover the insurance policies you’ve ignored and protect your future today. Don't wait!

Understanding the Different Types of Insurance Policies: Which One is Right for You?

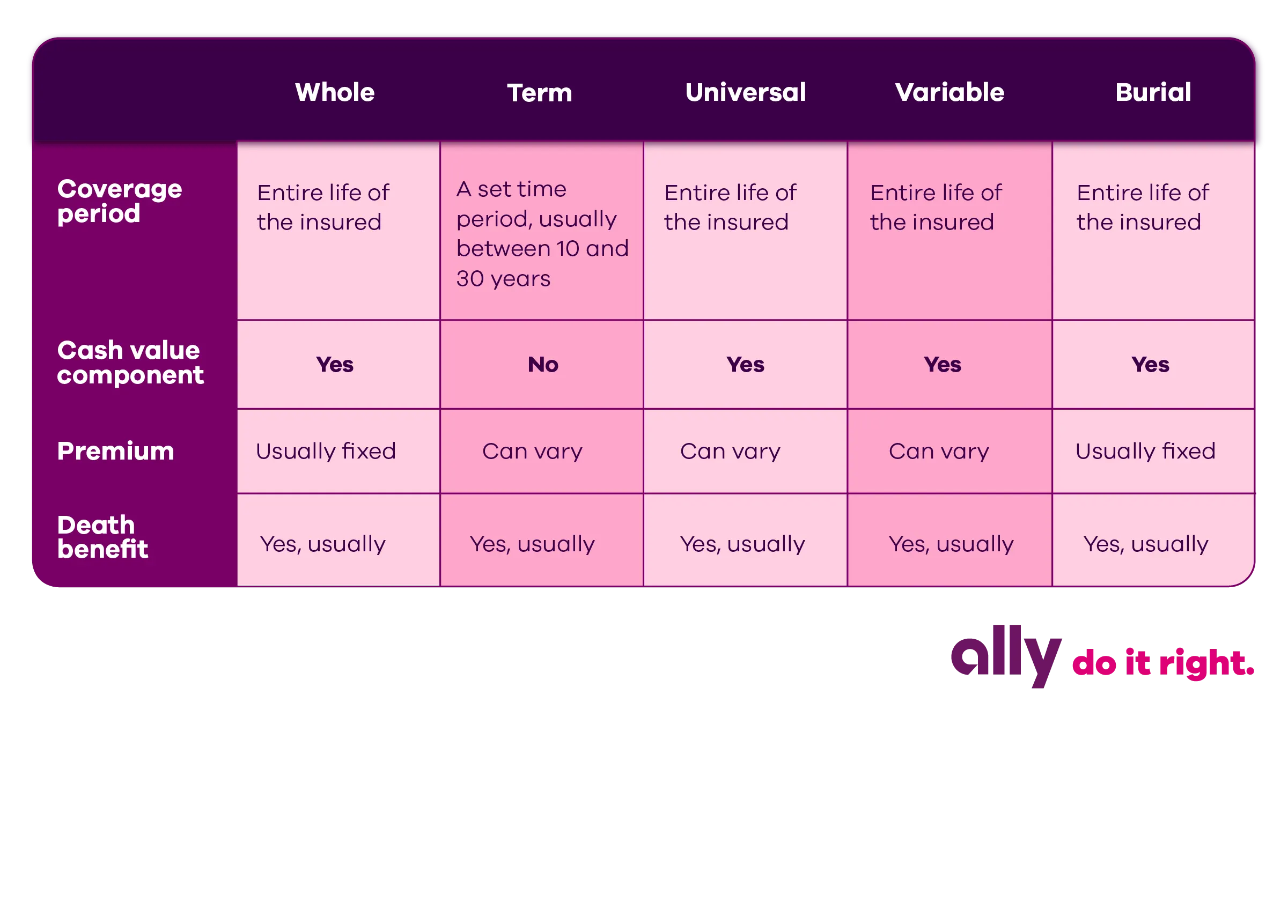

Choosing the right insurance policy can often feel overwhelming due to the multitude of options available. Insurance can broadly be categorized into several types, including health insurance, auto insurance, homeowners insurance, and life insurance. Each type serves a distinct purpose and offers various coverage levels to fit individual needs. For instance, health insurance provides financial protection against medical expenses, while auto insurance safeguards you against losses related to your vehicle. Understanding these categories is the first step in determining which policy aligns best with your personal circumstances.

Once you have a grasp of the different types of insurance, it’s crucial to consider factors such as your lifestyle, financial situation, and long-term goals. Here are a few questions to ask yourself when evaluating your options:

- What are the primary risks in my life that need coverage?

- How much can I afford in premiums versus out-of-pocket expenses?

- Am I looking for basic protection, or do I require comprehensive coverage?

Top 5 Reasons Why You Shouldn't Ignore Insurance Policies

Insurance policies are crucial for protecting your assets and ensuring financial stability in unpredictable situations. Ignoring these policies may lead to significant consequences, promptly impacting your life in various ways. Firstly, insurance policies provide a safety net for unexpected events, such as accidents or natural disasters. Without adequate coverage, you could face overwhelming expenses that may derail your financial plans.

Secondly, having the right insurance can give you peace of mind. Knowing that you have a plan in place allows you to focus on your daily life without the constant worry of potential mishaps. Additionally, many businesses are legally required to have certain types of insurance, making it essential to comply with regulations to avoid penalties. In conclusion, neglecting insurance policies can lead to dire financial repercussions and loss of peace of mind, so it’s vital to consider the benefits they provide.

What to Look for in Insurance Policies: A Comprehensive Guide

Choosing the right insurance policy can be a daunting task, but knowing what to look for can streamline the process. First, assess your specific needs by evaluating the types of coverage available, such as health, auto, life, and property insurance. Understanding your personal circumstances and risks is crucial. Additionally, consider the policy limits and deductibles; policies with lower premiums often come with higher deductibles, which means you’ll pay more out-of-pocket in the event of a claim. To help you organize your priorities, here are some critical factors to consider:

- Coverage types

- Premiums and deductibles

- Exclusions and limitations

- Claim processes

Another essential aspect to examine is the insurer's reputation and financial stability. Research customer reviews and industry ratings to ensure the company has a history of prompt claims processing and good customer service. Furthermore, pay attention to the terms and conditions of the policy, which often contain vital information regarding cancellation terms, renewal processes, and any potential fees. It’s beneficial to seek out a policy that offers flexibility and options for customization, thereby allowing you to tailor the coverage to suit your unique needs. Remember, an informed decision is key to securing the best possible protection for your assets and loved ones.