CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Insurance Face-Off: Who Wins Your Wallet?

Discover which insurance options truly save you money in our face-off! Unlock smart choices for your wallet today!

Understanding Premiums vs. Deductibles: Which Costs You More?

When purchasing insurance, two key terms you will often encounter are premiums and deductibles. A premium is the amount you pay periodically (monthly or annually) to maintain your insurance coverage, while a deductible is the amount you must pay out-of-pocket before your insurance kicks in. Understanding these two components is crucial because they directly impact your overall costs. For instance, if you opt for a policy with a lower premium, you might face a higher deductible, which could lead to significant out-of-pocket expenses in the event of a claim.

To determine which costs you more, it's important to assess your personal situation and insurance needs. Consider the following factors:

- Your health status and likelihood of needing medical care.

- Your financial capacity to pay a larger deductible if necessary.

- How often you make claims on your insurance policy.

The Great Insurance Debate: Is Bundling Really Worth It?

The debate over insurance bundling has gained traction in recent years, with many consumers questioning whether it truly offers the savings and convenience that insurance companies promise. Bundling typically refers to the practice of purchasing multiple insurance policies from a single provider, often resulting in discounts and simplified management. However, it's essential to evaluate if these benefits outweigh the potential downsides, such as being locked into a single company and possibly losing better coverage options elsewhere. Before making a decision, consumers should conduct thorough comparisons of policy features and prices from both bundling and separate providers.

Another critical factor in the great insurance debate revolves around individual circumstances and needs. For some, bundling can lead to significant premium savings and an easier claims process, especially for those who value convenience over complexity. On the other hand, those with unique or specialized insurance requirements might find it more beneficial to shop around for tailored policies. Therefore, it's vital for consumers to assess their personal situation and preferences when considering whether bundling is truly worth it.

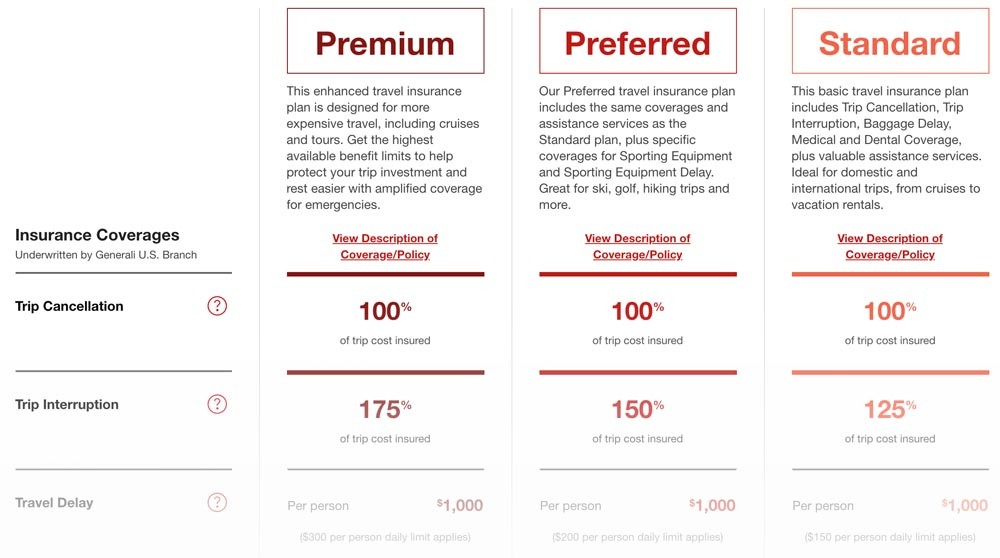

Are You Overpaying for Coverage? A Deep Dive into Policy Comparisons

When it comes to insurance, many individuals unknowingly overpay for coverage due to a lack of understanding or comparison shopping. It's crucial to take a deep dive into your current policy and evaluate whether you’re truly getting the best deal. Start by listing out your current coverage details and rates, then make comparisons with multiple providers. Utilize a structured approach, such as a policy comparison chart, to easily identify differences in premiums, deductibles, and coverage limits. This diligent examination is vital not just for saving money, but also for ensuring you have adequate protection.

Remember, it's not just about the price; the value of your coverage matters too. Conducting a thorough comparison can reveal significant gaps in coverage that might leave you vulnerable in times of need. Overpaying for coverage often stems from bundling policies without understanding the full scope of what you're paying for. Pay attention to endorsements, exclusions, and the insurer’s reputation for handling claims. By being proactive and informed, you can avoid unnecessary costs and make more confident decisions regarding your insurance needs.