CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Home Insurance: What Your Policy Isn’t Telling You

Explore hidden truths in your home insurance policy that could save you money and headaches. Discover what you don't know today!

Common Home Insurance Myths Debunked: What You Need to Know

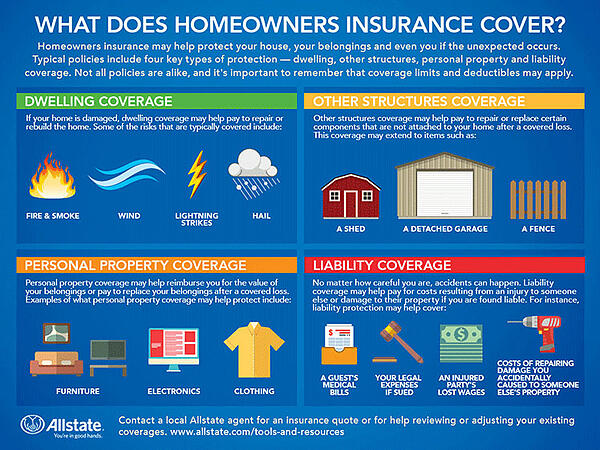

When it comes to home insurance, many homeowners are often misinformed. One common myth is that home insurance policies cover all types of damage. In reality, most standard policies do not include coverage for natural disasters such as floods or earthquakes. It's essential to read your policy carefully and understand the specific exclusions and limitations. Additionally, investing in separate flood or earthquake insurance might be necessary based on your geographical location to ensure comprehensive protection.

Another prevalent misconception is that home insurance is overly expensive and not worth the cost. Many people assume that they will pay a fortune for adequate coverage; however, the truth is that home insurance premiums can be surprisingly affordable, especially considering the financial protection it offers against unexpected incidents. To help manage costs, homeowners can take advantage of discounts for things like security systems, bundling with other insurance policies, or maintaining a good credit score. By debunking these myths, homeowners can make more informed decisions about their home insurance needs.

Hidden Exclusions in Your Home Insurance Policy: Are You Protected?

Hidden exclusions in home insurance policies can catch homeowners off guard when they need coverage the most. Many policies contain fine print that outlines specific situations or types of damage that are not covered, which can lead to frustrating surprises during a claim. Common exclusions include natural disasters like floods and earthquakes, as well as maintenance-related issues such as mold or pest infestations. Without proper understanding of these exclusions, homeowners may find themselves facing substantial out-of-pocket expenses in the event of a loss.

To protect yourself, it's crucial to review your home insurance policy carefully and discuss any unclear terms with your insurance agent. Consider asking about additional coverage options that could fill in gaps left by hidden exclusions. For example, you might need to purchase a separate flood insurance policy to guard against water damage. By being proactive and informed, you can ensure that you are genuinely protected against unexpected events that could jeopardize your home and financial stability.

10 Questions to Ask Your Home Insurance Agent Before You Buy

When considering home insurance, it's crucial to ask the right questions to ensure you get the coverage that fits your needs. Start by inquiring about the types of coverage available. For example, do they offer policies that cover both the structure of your home and your personal belongings? You should also ask about the differences between replacement cost and actual cash value, as understanding these terms can significantly affect your claim payout in the event of a loss.

Another important question to pose is about deductibles. What options are available, and how do they impact your premium? It's essential to find out whether the agent can help you customize your policy to balance your premium payments and out-of-pocket expenses. Additionally, don't forget to ask about discounts. Many insurers offer reductions for security systems, being a member of certain organizations, or bundling policies. The answers to these questions will help you make an informed decision.