CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Don't Get Caught in the Rain Without Your Renters Insurance

Protect your belongings and peace of mind! Discover why renters insurance is a must—don't get caught in the rain without it!

5 Reasons Renters Insurance is Essential Before the Storm Hits

Renters insurance is a crucial safety net that provides peace of mind, particularly before severe weather events. Here are 5 reasons why securing renters insurance is essential before the storm hits:

- Protection of Personal Belongings: Renters insurance covers the loss or damage of personal possessions caused by storms, including flooding, fire, or wind damage.

- Liability Coverage: If your home or apartment suffers damage that inadvertently affects your neighbors, renters insurance can cover legal fees and repairs.

- Additional Living Expenses: In the event of significant damage, renters insurance can help cover temporary housing costs, providing you with a safe place to stay while repairs are made.

Moreover, without renters insurance, individuals may face unexpected financial hardship in the aftermath of a storm. Claim Assistance: Many insurance providers offer claim assistance, ensuring that you navigate the process smoothly during an already stressful time. Lastly, considering the potential severity of storm season, peace of mind is invaluable. Knowing that your possessions and finances are protected allows you to focus on what truly matters during challenging times.

What Does Renters Insurance Cover in Case of Water Damage?

Renters insurance provides crucial financial protection for tenants, particularly when it comes to unexpected incidents like water damage. Generally, renters insurance covers personal belongings damaged by water, provided the source of the damage falls under covered events. This typically includes water damage from burst pipes, plumbing leaks, or accidents, such as overflowing bathtubs. However, it is essential to understand that it does not cover damage resulting from floods, which are usually excluded from standard policies. Therefore, if you live in a flood-prone area, you may need to consider additional flood insurance for comprehensive protection.

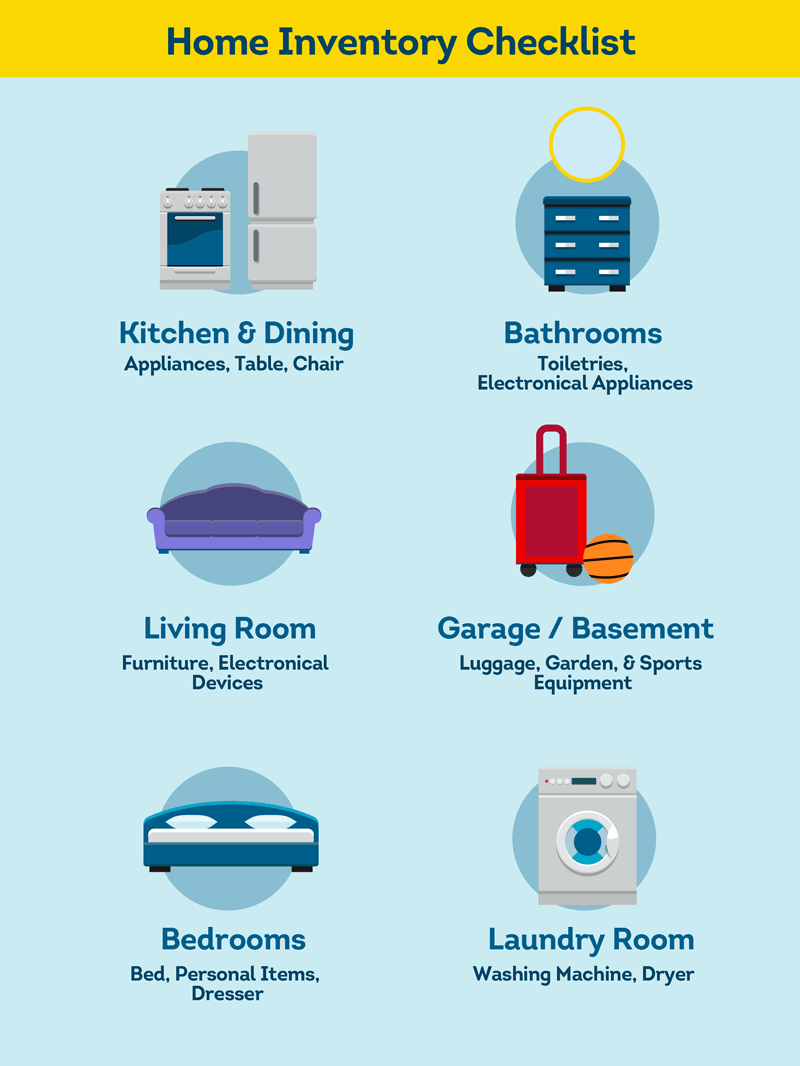

In the event of water damage covered by your renters insurance, you can file a claim that typically helps reimburse you for the value of your damaged personal property. This can include furniture, electronics, clothing, and more. It's important to keep an inventory of your possessions and take photos to aid in the claims process. Furthermore, your renters insurance may also cover additional living expenses if your rental unit becomes uninhabitable due to significant water damage. This includes costs related to temporary housing, meals, and other essential expenses during the period of displacement, offering peace of mind in a challenging situation.

Is Your Belongings Coverage Enough? Understanding Renters Insurance Limits

When it comes to renters insurance, one of the most critical aspects to consider is your belongings coverage. Many renters assume that their policy will fully protect all their possessions, but in reality, there are often limits to what is covered and how much compensation you can receive. For example, if your policy has a limit of $30,000, and your belongings are valued at $50,000, you could face significant out-of-pocket expenses in the event of a loss. It's essential to take inventory of your belongings and assess their total value to ensure you have adequate coverage.

Additionally, renters insurance policies typically categorize belongings into specific classes, each with its own limits. High-value items such as jewelry, electronics, and artwork may not be fully protected unless you have added specific endorsements or riders to your policy. Furthermore, understanding the difference between 'actual cash value' and 'replacement cost' coverage can greatly impact your payout during a claim process. To avoid unexpected financial burdens, regularly review your policy limits and adjust them as your circumstances change, ensuring your belongings coverage remains sufficient.