CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Disability Insurance: Why It's Like a Safety Net for Your Future

Discover how disability insurance serves as your financial safety net, protecting your future when unexpected challenges arise. Don't miss out!

The Essential Guide to Disability Insurance: Protecting Your Income

Disability insurance is a crucial financial safety net that protects your income in the event of an injury or illness that prevents you from working. With the rise of unforeseen circumstances such as accidents and health crises, securing disability insurance has become more essential than ever. It ensures that you can maintain your standard of living and meet ongoing financial obligations even when you cannot earn a paycheck. Understanding the different types of disability insurance—such as short-term and long-term policies—can help you make informed decisions about the best coverage for your needs.

When considering disability insurance, it is vital to evaluate key factors such as the waiting period, benefit duration, and coverage amounts. Disability insurance policies can vary widely, so taking the time to read the fine print and comprehend the terms is important. Additionally, seeking advice from a financial advisor may provide insights tailored to your unique situation, ensuring that you select a policy that adequately safeguards your income. In an unpredictable world, having the right coverage can provide peace of mind and financial stability.

Disability Insurance FAQs: Everything You Need to Know

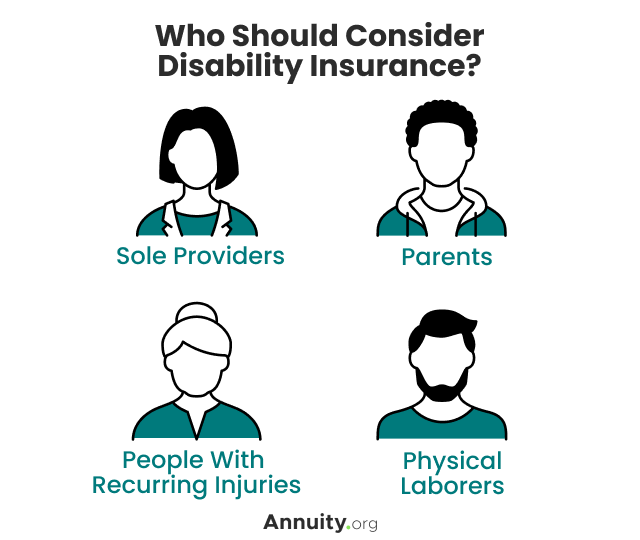

Disability insurance is a crucial financial safety net that protects your income in case you are unable to work due to illness or injury. Many individuals have questions regarding how this type of insurance operates, what it covers, and who should consider purchasing it. Common FAQs include: What qualifies as a disability? and How much coverage do I need? Understanding these key aspects can help you make informed decisions about your financial planning.

When selecting a disability insurance policy, it’s important to consider various factors such as the elimination period, which is the time you must wait before benefits begin, and the benefit period, which is how long you would receive payments. Additionally, you may wonder how premiums are calculated and whether tax implications apply to the benefits received. Remember, navigating the world of disability insurance can be complex, but being well-informed can help you secure the protection you need.

How Disability Insurance Acts as Your Financial Safety Net

Disability insurance serves as a crucial financial safety net for individuals who may face unforeseen circumstances that hinder their ability to work. By providing a portion of your income during periods of disability, this type of insurance helps to cover essential expenses such as mortgage payments, utility bills, and daily living costs. Without this protection, many individuals could find themselves in dire financial straits, struggling to meet their obligations and maintain their quality of life.

Moreover, having disability insurance allows individuals to focus on recovery rather than financial stress. It ensures that you have the necessary resources to cope with unexpected injuries or illnesses, ultimately promoting a smoother path to recovery. In fact, studies show that nearly one in four individuals will experience a disability at some point in their careers, underscoring the importance of securing a robust financial safety net. By investing in this type of coverage, you safeguard not only your income but also your peace of mind.