CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Whole Life Insurance: Your Ticket to a Worry-Free Tomorrow

Unlock peace of mind with whole life insurance! Discover how it secures your future and provides worry-free living today.

Understanding Whole Life Insurance: Key Benefits for Your Future

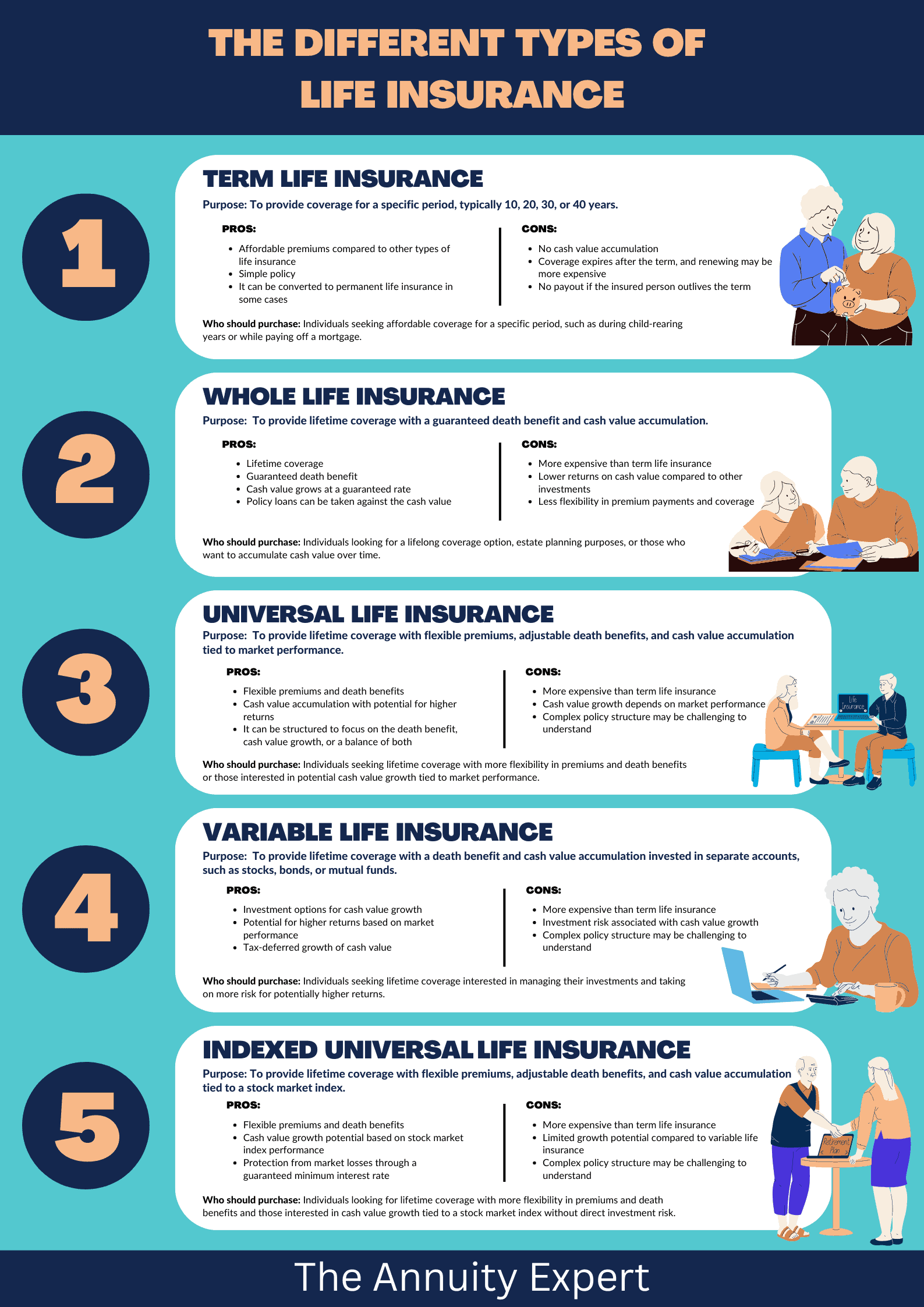

Whole life insurance offers a unique blend of lifelong coverage and cash value accumulation, making it an attractive option for those seeking financial security. Unlike term life insurance, which provides coverage for a specific period, whole life insurance lasts your entire lifetime as long as premiums are paid. One of the key benefits is the predictable premium payments that remain consistent throughout the policyholder's life, providing peace of mind against rising costs. Additionally, the cash value component grows at a guaranteed rate, creating a savings element that policyholders can borrow against or withdraw during their lifetime.

Another significant advantage of whole life insurance is the death benefit it provides to your beneficiaries. This financial safety net ensures that your loved ones are protected from potential financial burdens after your passing. Whole life policies also offer the potential for dividends, depending on the insurance company’s performance, which can be reinvested, taken in cash, or used to reduce premiums. When combined, these aspects create not just a life insurance policy but a comprehensive financial tool that supports your long-term wealth-building goals and secures your family's future.

Is Whole Life Insurance the Right Choice for You? 5 Questions to Consider

When considering whether whole life insurance is the right choice for you, it's essential to ask yourself a few key questions. First, evaluate your long-term financial goals. Whole life insurance provides a cash value component that grows over time, offering a source of savings in addition to the death benefit. Ask yourself: Do I want a policy that not only protects my loved ones but also serves as a financial asset that I can tap into later? Understanding the dual purpose of whole life insurance can help determine if it aligns with your financial strategy.

Another important consideration is your current and future financial situation. Whole life insurance typically comes with higher premiums compared to term life insurance. Therefore, it's crucial to assess your budget and long-term financial commitments. Ask yourself: Can I comfortably afford these premiums without compromising my other financial responsibilities? Additionally, consider your age and health; these factors can affect both your eligibility and the cost of coverage. By posing these questions, you'll gain a clearer perspective on whether whole life insurance meets your needs.

How Whole Life Insurance Can Secure Your Family's Financial Future

Whole life insurance is a powerful financial tool that not only provides a death benefit but also builds cash value over time. By choosing a whole life policy, policyholders can ensure that their loved ones are protected from financial hardships in the event of their passing. The guaranteed death benefit can help cover essential expenses such as mortgage payments, child care, and daily living costs. This level of security can relieve your family from the burden of financial instability during a tragic time.

Additionally, the cash value component of whole life insurance grows at a guaranteed rate, offering a unique savings opportunity. This cash value can be accessed for various needs, such as funding your children's education or serving as an emergency fund. By incorporating whole life insurance into your financial plan, you are not only providing immediate support through death benefits but also creating a lasting legacy that contributes to your family's overall financial health.