CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

When Life Throws You Curveballs: Why You Need Disability Insurance

Discover why disability insurance is your safety net when life throws unexpected challenges. Protect your future today!

Understanding Disability Insurance: A Safety Net for Unexpected Life Changes

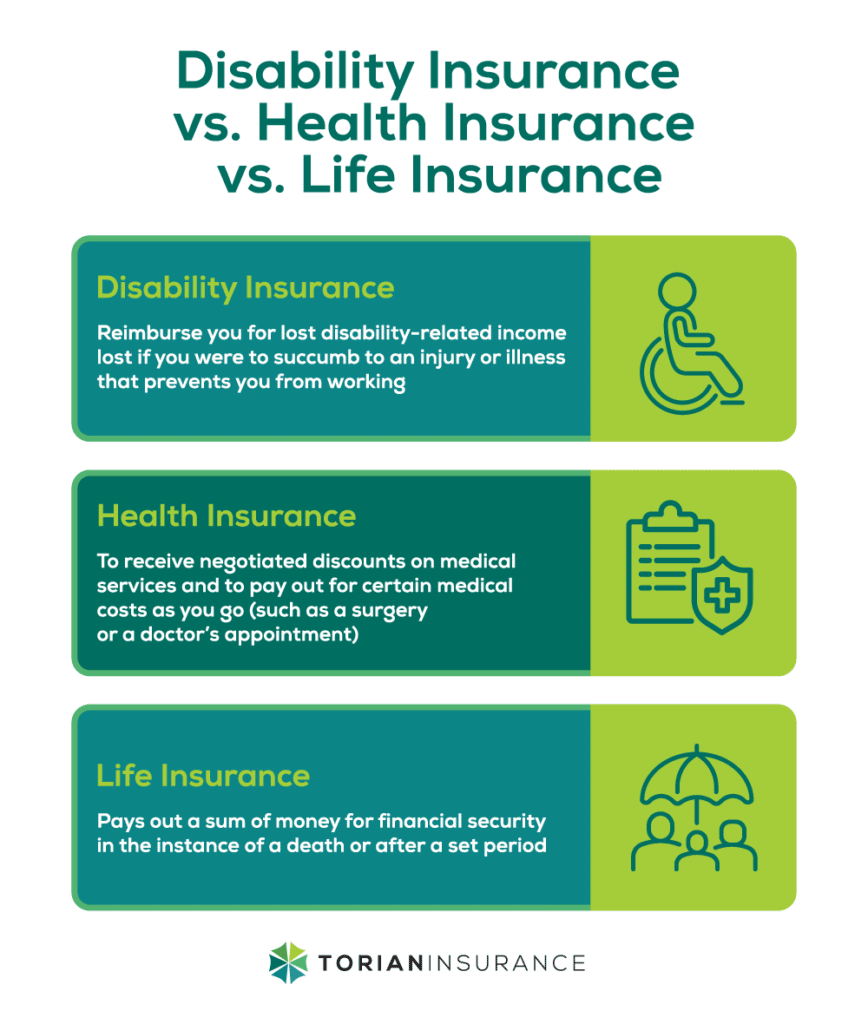

Disability insurance serves as a critical safety net for individuals facing unexpected life changes. Whether due to illness or an accident, the inability to work can lead to significant financial strain. This type of insurance provides a source of regular income, helping to cover essential expenses like housing, medical bills, and everyday living costs. By securing a disability policy, individuals can prepare for unforeseen circumstances, ensuring that a sudden loss of income does not spiral their finances into disarray.

The importance of disability insurance cannot be overstated, particularly in a world where unpredictable events can disrupt even the most carefully laid plans. Statistics reveal that a significant percentage of workers will experience a disability lasting three months or longer during their working years. Therefore, understanding the terms, benefits, and types of disability insurance is vital. This knowledge empowers individuals to make informed decisions, allowing them to secure their financial future and provide peace of mind during challenging times.

Top Common Myths About Disability Insurance Debunked

Disability insurance is often surrounded by myths that can mislead individuals about its purpose and benefits. One common myth is that disability insurance is only for those in physically demanding jobs. In reality, anyone can become disabled due to accidents, illnesses, or unforeseen medical conditions, regardless of their occupation. This belief can leave many unprotected when they need coverage the most. According to estimates, nearly 1 in 4 workers will experience a disability before they retire, highlighting the importance of understanding the true nature of disability insurance.

Another widespread myth suggests that all disability insurance policies are the same. In truth, coverage can vary significantly between policies, particularly in terms of definitions, benefits, and waiting periods. It's crucial to carefully read the policy’s details and not assume that a standard plan will meet your needs. Individuals should consider speaking with a knowledgeable advisor to ensure they select a policy that provides adequate coverage tailored to their situation. Debunking these myths allows more people to take proactive steps in securing their financial future.

Do You Really Need Disability Insurance? The Answer May Surprise You

When considering your financial security, you might wonder, do you really need disability insurance? The answer may depend on various factors including your profession, health status, and financial obligations. Many people assume that their health will remain intact throughout their careers, but statistics reveal that disability can happen when least expected. In fact, studies show that one in four workers will experience a disability lasting longer than 90 days during their working years. This startling fact highlights the importance of evaluating your personal circumstances to determine if having a safety net is essential.

Moreover, the need for disability insurance becomes more pressing when you consider the potential impact on your income and lifestyle. Without adequate coverage, a sudden loss of income due to a disability could lead to overwhelming financial stress. It's crucial to assess your current savings, debt, and essential expenses to understand the risks involved. So, while it may seem unnecessary now, investing in disability insurance could be a vital decision that secures your financial future and peace of mind if the unexpected occurs.