CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Term Life Insurance: Your Safety Net Without the Clutter

Discover how term life insurance can simplify your protection and provide peace of mind—your safety net without the hassle!

Understanding Term Life Insurance: Key Benefits and Features

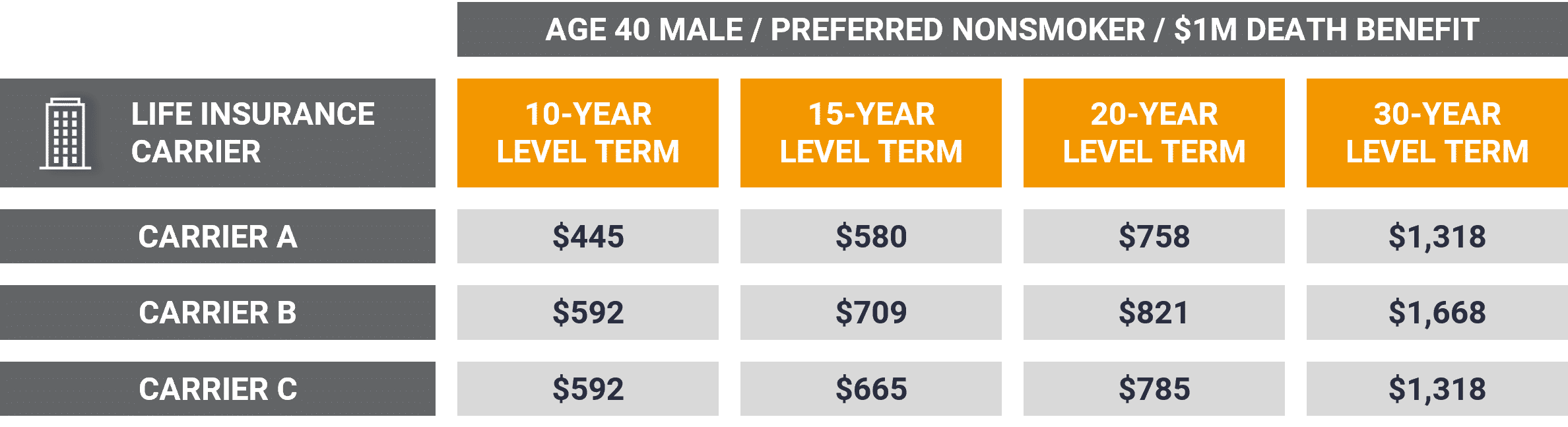

Understanding Term Life Insurance is crucial for anyone looking to secure their family's financial future. This type of insurance provides coverage for a specified period, typically ranging from 10 to 30 years, offering peace of mind knowing that loved ones are protected in case of an untimely death. The primary advantage of term life insurance is its affordability compared to other types of life insurance. Lower premiums enable policyholders to obtain a higher coverage amount, ensuring that significant financial obligations, such as mortgage payments and children's education, are fulfilled.

Additionally, term life insurance is straightforward and easy to understand. Unlike permanent life insurance, which accumulates cash value over time, term policies focus solely on providing a death benefit. This simplicity makes it easier for individuals to choose the right coverage amount without complicated financial jargon. Furthermore, many insurers offer the option to convert a term policy into a permanent one, allowing policyholders to adapt their insurance needs as they age and their financial situation evolves.

How Term Life Insurance Provides Peace of Mind for Your Loved Ones

Term life insurance offers a safety net for families during uncertain times, ensuring that your loved ones are financially protected in the event of your passing. This type of insurance provides a death benefit that can cover essential expenses such as mortgage payments, daily living costs, and children's education. By securing a term life policy, you can alleviate the financial burden your family might experience, allowing them to focus on healing rather than worrying about their financial stability.

Moreover, having term life insurance fosters peace of mind for both policyholders and their families. Knowing that your financial responsibilities are covered can reduce anxiety about the future, allowing you to live life more fully. In addition, many policies offer the option to convert to permanent life insurance, providing flexibility if your needs change over time. Ultimately, investing in term life insurance is not just about securing funds; it is about providing a lasting sense of security and preserving your family's legacy for years to come.

Is Term Life Insurance Right for You? Common Questions Answered

When considering whether term life insurance is the right option for you, it's essential to evaluate your financial goals and family needs. Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, making it a cost-effective choice for many individuals. This type of policy is designed to offer financial protection for your loved ones in case of your untimely passing, allowing them to cover expenses like mortgage payments, educational costs, and daily living expenses.

One common question is, who should consider term life insurance? This policy is ideal for those with dependents or significant financial obligations. Term life insurance can be particularly beneficial for young families, individuals with outstanding debts, or those looking to secure their children's future. However, it’s crucial to assess your personal circumstances, such as income stability and long-term financial plans, to determine if term life insurance aligns with your overall financial strategy.