CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Term Life Insurance: Because Nothing Says 'I Love You' Like a Safety Net

Protect your loved ones with term life insurance—secure their future and show your love in the best way possible!

Understanding Term Life Insurance: How It Provides Financial Security for Your Loved Ones

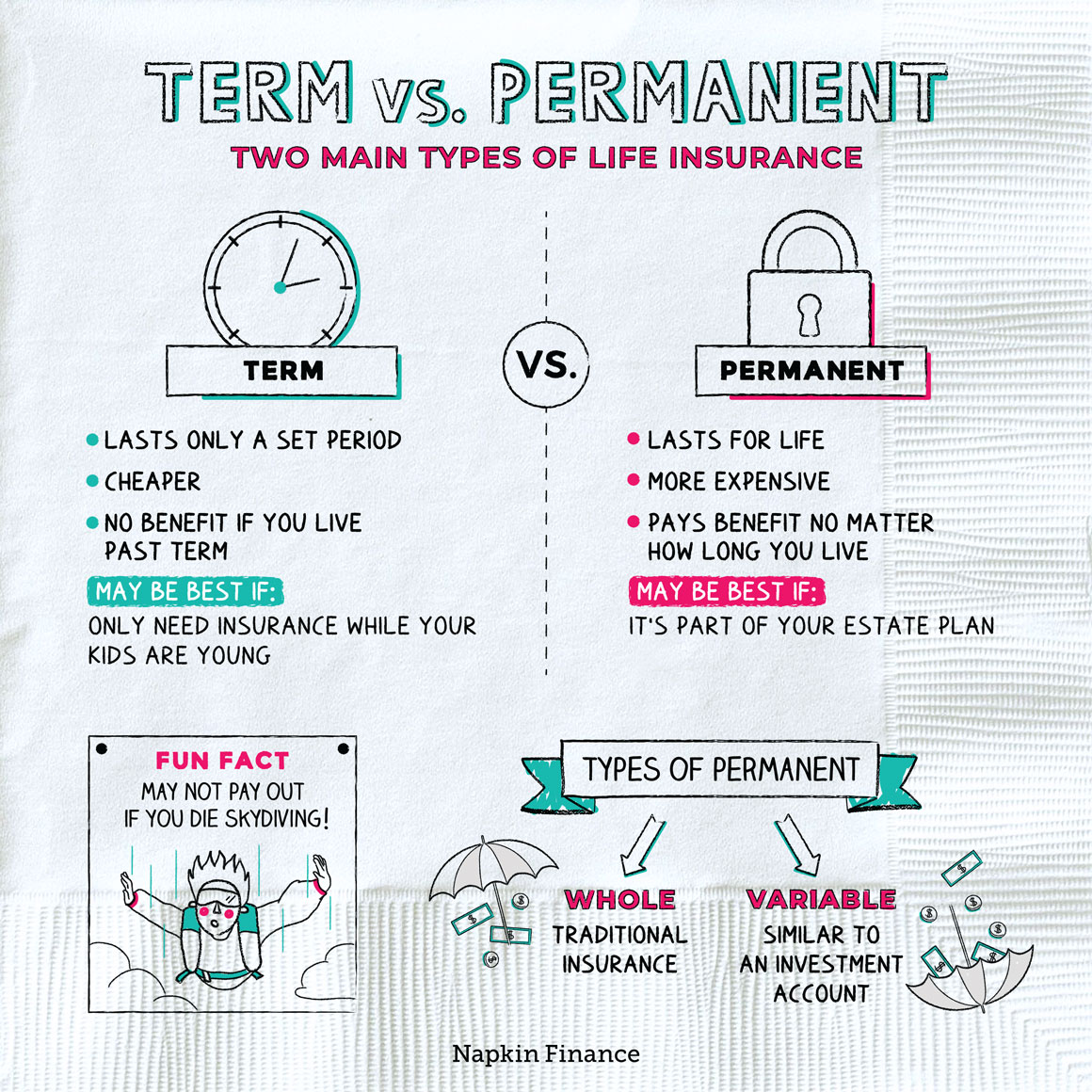

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from 10 to 30 years. This means that if the policyholder passes away during the term, their beneficiaries receive a death benefit, providing them financial security during a significant time of need. One of the primary benefits of term life insurance is its affordability; because it doesn't accumulate cash value and only pays out if the insured dies within the term, premiums are generally lower than those of whole life policies. This makes it an attractive option for individuals who want to ensure that their loved ones are protected financially in the event of an unexpected loss.

By securing term life insurance, policyholders can have peace of mind knowing that their family will be financially supported. This form of insurance can cover various expenses that may arise after their death, such as mortgage payments, children's education, and daily living expenses. In essence, term life insurance is designed to replace the lost income that the insured would have provided, ensuring that loved ones can maintain their quality of life. Furthermore, many policies offer options for renewal or conversion, allowing policyholders to extend their coverage or switch to a permanent policy as their financial needs evolve over time.

Top Reasons to Consider Term Life Insurance for Your Family's Future

When it comes to protecting your family's future, term life insurance offers a straightforward and affordable option. One of the top reasons to consider this type of coverage is its cost-effectiveness. Unlike permanent life insurance policies, term life provides coverage for a specific period, typically 10, 20, or 30 years, allowing you to secure substantial financial protection at lower premiums. This savings can enable you to allocate funds toward other essential aspects of your family's needs, including education, retirement, and everyday expenses.

Another crucial reason to invest in term life insurance is that it offers peace of mind during uncertain times. Knowing that your loved ones will have financial support in the event of your untimely passing can alleviate stress and anxiety. With a death benefit that can cover outstanding debts, mortgage payments, and living expenses, your family can maintain their quality of life without facing financial hardship. Ultimately, the security offered by term life insurance ensures that your family's future remains bright, regardless of life's unpredictability.

Is Term Life Insurance Right for You? Key Questions to Ask Before Buying

Deciding whether term life insurance is right for you requires careful consideration of your financial situation and family needs. Start by asking yourself a few key questions:

- What is my primary goal for purchasing life insurance?

- How many dependents do I have, and what would their financial situation look like if I were no longer around?

- What are my current debts and future expenses, such as college tuition for my children?

Another important aspect to evaluate is how long you need coverage. Term life insurance is generally more affordable than permanent life insurance, making it an attractive option for those who need coverage for a specific period, such as until children graduate or a mortgage is paid off. Consider asking yourself:

- What length of term fits my financial obligations?

- Am I comfortable with the idea of outliving my policy?

- Are there other financial instruments I can use to build savings, or do I prefer a straightforward insurance option?