CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Term Life Insurance: A Love Letter to Your Family's Future

Secure your family’s future with term life insurance—discover how this loving choice can protect what matters most.

What You Need to Know About Term Life Insurance: Protecting Your Loved Ones

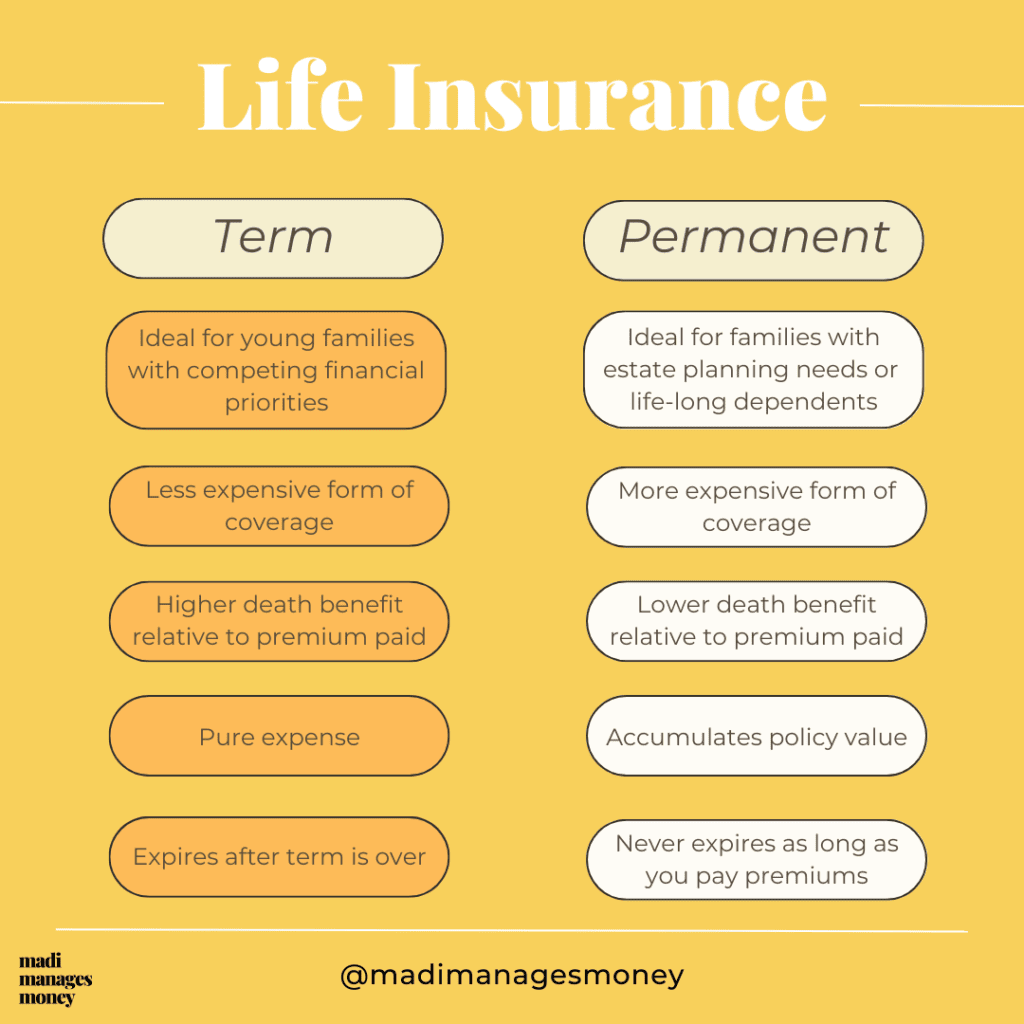

Term life insurance is a vital financial tool that offers peace of mind by providing a safety net for your loved ones in the event of your untimely passing. Unlike whole life insurance, which builds cash value over time, term life insurance is designed specifically to cover you for a set period, usually ranging from 10 to 30 years. This can be particularly beneficial for young families or individuals with significant financial obligations, such as a mortgage or education expenses for children. Should something happen to you during this term, your beneficiaries will receive a death benefit, ensuring they are financially secure and can maintain their standard of living.

When considering term life insurance, it's important to evaluate several key factors:

- The Coverage Amount: Determine how much money your loved ones would need to cover living expenses, debts, and future financial goals.

- Policy Length: Choose a term length that aligns with your financial responsibilities.

- Premium Costs: Compare premiums among different insurers to find a policy that fits your budget without sacrificing coverage.

Term life insurance provides a straightforward and cost-effective way to protect your family’s financial future. By understanding its benefits and making informed choices, you can ensure that your loved ones are taken care of, even when you’re not there to provide for them.

5 Reasons Why Term Life Insurance is a Smart Investment for Your Family's Future

Term life insurance is often regarded as a smart investment for families, providing peace of mind and financial security. One of the most compelling reasons to consider this type of insurance is its affordability. Compared to whole life policies, term life insurance typically offers lower premiums, allowing families to secure significant coverage without straining their budgets. This means that in the event of an unexpected loss, your loved ones can maintain their quality of life and meet essential expenses such as mortgage payments, education costs, and daily living expenses.

Another reason to invest in term life insurance is its flexibility. Most policies allow you to choose the coverage duration, which can range from 10 to 30 years, depending on your family’s needs. This means you can align the policy term with specific financial goals, such as the years until your children are financially independent or until your mortgage is paid off. Additionally, many policies offer the option to convert to a permanent policy later on, providing a safety net as your family's financial situation evolves.

Term Life Insurance Explained: How It Can Secure Your Family's Financial Stability

Term life insurance is a straightforward and affordable type of life insurance that provides coverage for a specified period, or term, usually ranging from 10 to 30 years. This insurance is designed to offer financial protection to your loved ones in the event of your untimely passing. The benefits of term life insurance extend beyond mere peace of mind; it secures your family's financial stability by replacing lost income, covering outstanding debts, and ensuring that daily living expenses are managed while they adjust to the new circumstances. With a clear understanding of the terms and conditions, policyholders can select the coverage that best aligns with their family's needs.

One of the key advantages of term life insurance is its affordability compared to whole life insurance, making it an accessible option for many families. Premiums are typically lower, allowing you to invest in a higher coverage amount without breaking the bank. Additionally, many policies offer a conversion option, allowing you to switch to a permanent insurance plan later if your needs change. Ultimately, term life insurance empowers families to navigate the uncertainties of life with confidence, knowing they have a financial safety net in place should the unexpected occur.