CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Pet Insurance: A Safety Net for Your Four-Legged Houdini

Discover how pet insurance can safeguard your furry escape artist from unexpected vet bills and keep both of you worry-free!

Understanding Pet Insurance: Why It's Essential for Your Furry Escape Artist

Understanding Pet Insurance is crucial for every pet owner, especially if you have a furry escape artist that loves to explore the great outdoors. With their adventurous spirit, these pets can easily find themselves in risky situations, leading to unexpected veterinary bills. Having pet insurance can provide peace of mind by covering a significant portion of medical expenses when your beloved companion requires emergency care or treatment for injuries sustained during their escapades.

Moreover, pet insurance offers more than just financial support; it allows you to make swift decisions regarding your pet's health without the burden of cost. Many policies also include preventive care coverage, which can help with routine check-ups and vaccinations, ensuring your adventurous friend stays in tip-top shape. By prioritizing understanding pet insurance, you are taking a proactive step in safeguarding your furry escape artist's well-being and ensuring they can continue to explore with confidence.

How Pet Insurance Can Save You from Unexpected Veterinary Bills

Having a pet is a rewarding experience, but it also comes with its share of responsibilities and potential expenses. One of the most significant financial burdens pet owners can face is unexpected veterinary bills. Pet insurance can act as a safety net, ensuring that you are financially prepared for emergencies, accidents, or sudden illnesses that may arise. **With pet insurance**, you can focus on getting your furry friend the care they need without the stress of high costs that can come with unexpected treatments.

Many pet owners are unaware of the high costs associated with veterinary care until they face an emergency. For example, a simple operation can range from hundreds to thousands of dollars. By investing in **pet insurance**, you can save yourself from having to make tough decisions during critical moments. Typically, pet insurance plans will cover a variety of services, including surgery, hospitalization, and medication. This means you can provide your pet with the best possible care while keeping your budget intact.

Is Pet Insurance Worth It? Common Questions Answered

When considering whether pet insurance is worth the investment, it's important to evaluate both the potential benefits and drawbacks. Many pet owners find themselves facing unexpected veterinary bills that can quickly escalate into thousands of dollars, especially in the case of accidents or chronic illnesses. With pet insurance, these costs can be mitigated, providing peace of mind knowing that you can afford quality care for your beloved companion. While some may argue that paying for insurance seems redundant if your pet is healthy, the reality is that unforeseen events can and often do occur, making the safety net of insurance appealing.

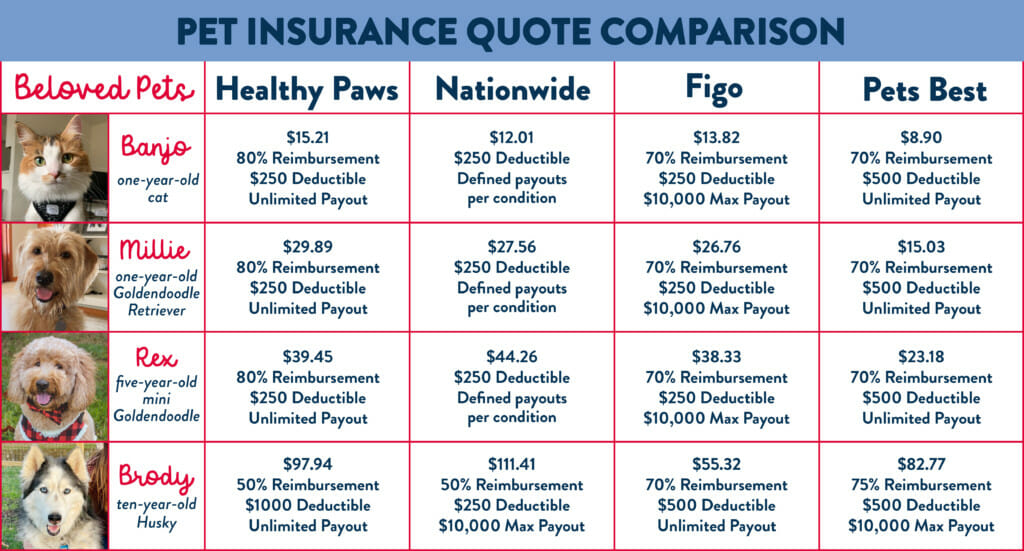

Common questions about pet insurance often revolve around coverage options, costs, and what to do in case of a claim. Is preventive care included? While most plans focus on accidents and illnesses, some offer add-ons for routine check-ups and vaccinations. Additionally, pet insurance costs can vary widely based on factors such as your pet’s age, breed, and your location. It’s also crucial to understand the claims process; many providers require you to pay veterinary bills upfront and then submit reimbursement claims. Ultimately, careful research and consideration of your pet’s specific needs will help determine if pet insurance is a worthy investment for you.