CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

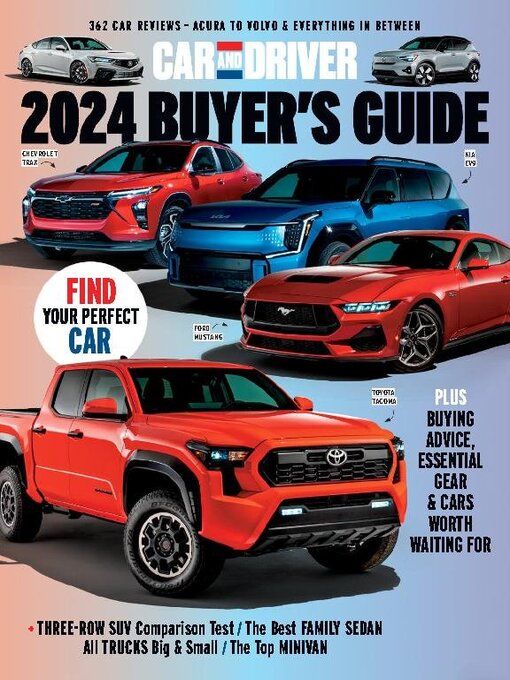

Navigating the Auto Jungle: Your Survival Kit for Car Buying

Unlock the secrets to car buying success! Navigate the auto jungle with our ultimate survival kit and drive away with confidence.

10 Essential Tips for First-Time Car Buyers

Buying your first car can be an exciting yet daunting experience. To make the process smoother, here are 10 essential tips for first-time car buyers that will help you make informed decisions. First and foremost, create a budget that includes not just the purchase price but also ongoing expenses like insurance, fuel, and maintenance. This will give you a realistic view of what you can afford. Next, consider the type of car that suits your lifestyle—whether you need a compact for city driving or a larger vehicle for family use.

Once you have a budget and a type of car in mind, research is key. Investigate various makes and models, focusing on reliability, fuel efficiency, and safety ratings. Make a list of your top choices and read reviews from current owners. When you're ready to visit dealerships, always take the car for a test drive to assess its comfort and performance. Finally, don't rush into the purchasing decision; take your time to compare prices and consider negotiating for a better deal.

Understanding Car Financing: What You Need to Know

When it comes to car financing, understanding the various options available to you is crucial for making the best financial decision. There are several methods to finance a vehicle, including auto loans, leasing agreements, and even paying in cash. Each option has its own advantages and disadvantages, but many consumers turn to auto loans due to their flexibility. With an auto loan, you have the ability to own the car outright once the loan is paid off, while leasing typically requires you to return the vehicle at the end of the contract.

Before you proceed with car financing, it's essential to evaluate your budget and determine how much you can afford. Consider factors such as your monthly income, existing debts, and how much you can allocate towards a car payment. You may also want to check your credit score, as this will significantly impact the interest rates and loan terms available to you. Keep in mind that a higher credit score generally results in lower interest rates, ultimately saving you money over the life of the loan.

Is Leasing a Car the Right Choice for You?

Deciding whether leasing a car is the right choice for you depends on several factors, including your driving habits, budget, and personal preferences. Leasing typically offers lower monthly payments compared to buying, allowing you to drive a newer model with the latest features without the hefty price tag. However, it's essential to consider your mileage needs, as most leases come with mileage limits, often between 10,000 to 15,000 miles per year. Exceeding these limits can lead to significant fees, which might outweigh the benefits of leasing.

Another important aspect to evaluate is your long-term financial goals. If you prefer driving a new car every few years and value warranty coverage, leasing might work well for you. However, if you plan to keep a vehicle for an extended period, purchasing could be more economical in the long run. Ultimately, it's crucial to analyze your lifestyle and budget before making a decision. By weighing the pros and cons, you can determine if leasing a car aligns with your needs and financial situation.