CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

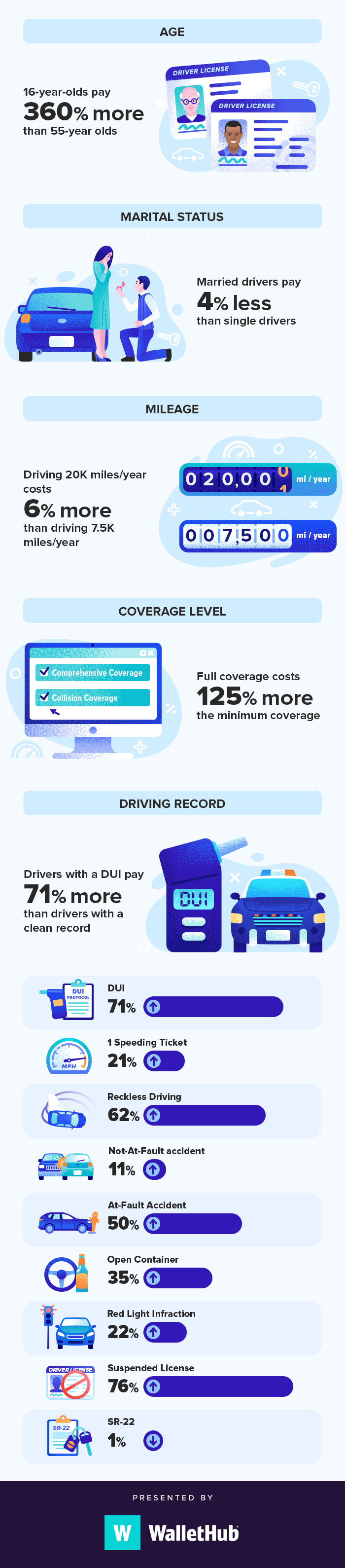

Insuring Your Wallet: The Secret Life of Cheap Coverage

Discover how to save money on insurance with smart strategies. Unlock the secrets of cheap coverage and protect your wallet today!

Affordable Insurance: Uncovering the Myths Behind Cheap Coverage

Affordable Insurance often gets a bad rap, with many consumers assuming that cheap coverage equates to inadequate protection. However, this isn't always the case. In reality, affordable insurance can provide comprehensive policies at a fraction of the cost without compromising on essential benefits. One common myth is that lower premiums mean fewer services; however, many insurance providers offer competitive pricing without skimping on coverage, often due to their effective operational strategies and technological advancements. Understanding these factors can help consumers distinguish between genuinely affordable options and policies that may leave them underinsured.

Another prevalent myth is that cheap insurance policies are not worth considering. This notion can deter potential customers from exploring valuable options that fit their budgetary constraints. For instance, shopping around and comparing quotes from various providers can reveal hidden gems in the market. Many insurers now tailor **affordable insurance** plans to meet diverse needs, offering customizable options designed to deliver adequate coverage at lower prices. Don't let misconceptions about cheap coverage cloud your judgment; doing thorough research can uncover great opportunities for cost-effective insurance solutions.

How to Find Hidden Gems in Budget-Friendly Insurance Plans

Finding hidden gems in budget-friendly insurance plans can feel like searching for a needle in a haystack, but with the right strategies, you can uncover excellent value. Start by researching various providers and their offerings. Many insurance companies provide basic plans that may not be heavily advertised, but they can be tailored to fit your needs without breaking the bank. Make a comprehensive list of potential plans and their coverage options to evaluate which ones align with your requirements.

Another effective method is to read customer reviews and testimonials. These can shed light on the experiences of policyholders regarding the claims process, customer service, and overall satisfaction with their budget-friendly insurance plans. Additionally, consider utilizing comparison tools that allow you to filter options based on cost and coverage. Don’t hesitate to reach out to insurance agents who can guide you through the available plans, helping you discover unique benefits that may not be immediately apparent.

Is Cheap Insurance Worth It? A Deep Dive into Coverage and Costs

When considering insurance options, many individuals are often drawn to cheap insurance as a way to save money. However, it's crucial to weigh the pros and cons of such policies. Cheap insurance can come with limited coverage that may not adequately protect you in case of an accident or disaster. For instance, policies may lack essential features like comprehensive coverage or higher liability limits, leading to potential out-of-pocket expenses when you need it the most.

Moreover, not all cheap insurance is created equal. Some providers might offer low premiums due to subpar customer service or numerous exclusions in their policies. When evaluating your options, consider the following factors:

- Coverage limits

- Customer reviews

- Claim processes