CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Insurance Showdown: Finding the Best Deal in a Sea of Policies

Uncover hidden gems in insurance! Dive into the ultimate showdown to find the best deal among countless policies. Don't miss out!

Comparing Coverage: What to Look for in Insurance Policies

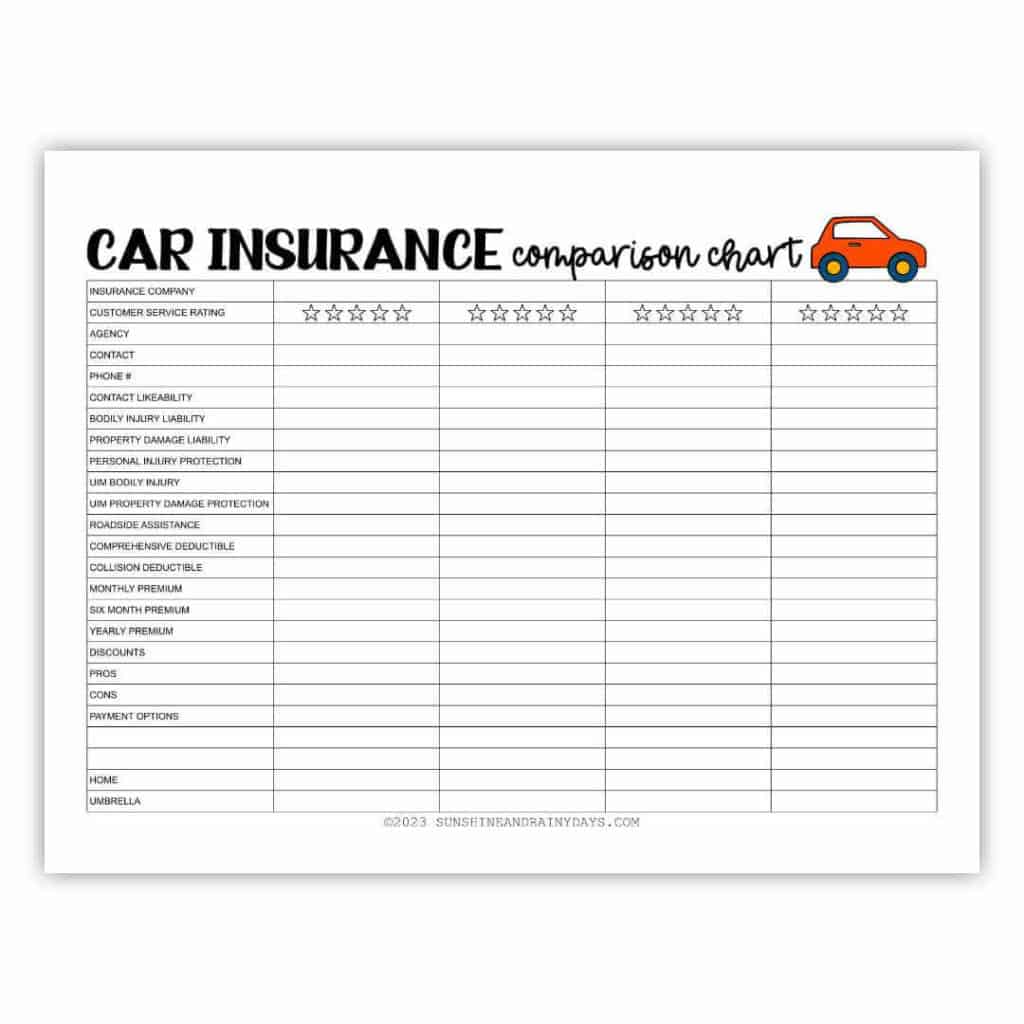

When evaluating insurance policies, it is essential to understand the different types of coverage available. Each type of insurance serves a unique purpose and includes specific elements that can impact your overall protection. For example, auto insurance often consists of liability coverage, collision coverage, and comprehensive coverage. In contrast, homeowners insurance typically includes dwelling coverage, personal property coverage, and liability protection. Before selecting a policy, carefully consider the specific needs of your situation and the extent of coverage required to adequately protect your assets.

Another critical factor when comparing insurance coverage is the deductible and premium costs. A lower premium might seem attractive, but it could come at the cost of higher deductibles, meaning you will have to pay more out of pocket before your insurance kicks in. Additionally, examine the exclusions in the policy, as these can significantly affect your coverage. Make a checklist of what is important to you, and don’t hesitate to ask insurance agents detailed questions about policy terms to ensure you make an informed decision that best suits your needs.

Is Cheaper Always Better? The Truth About Insurance Costs

When it comes to insurance, many consumers are often drawn to the allure of lower premiums. However, insurance costs are not solely determined by the price tag. It's crucial to consider what you are actually getting for your money. A cheaper policy may seem attractive at first glance, but it can leave you exposed to significant financial risks if it doesn't offer adequate coverage. Evaluating the coverage limits and the specifics of the policy is essential to ensure that you won’t be left vulnerable in the event of a claim.

Moreover, opting for a low-cost insurance option can sometimes lead to a false sense of security. Many individuals find themselves caught off-guard during a crisis when they discover that their policy has exclusions or insufficient limits. To evaluate whether a policy is the right fit for you, consider factors such as the insurer's reputation, customer service ratings, and the comprehensiveness of the coverage. Ultimately, the most prudent choice may often be a policy that is slightly more expensive but offers the peace of mind that comes with better protection.

Top 5 Mistakes to Avoid When Shopping for Insurance Policies

When it comes to shopping for insurance policies, many individuals make common mistakes that can lead to inadequate coverage or unnecessary expenses. One of the most significant errors is failing to thoroughly compare different insurance providers. Not all policies are created equal, and premiums can vary widely for similar coverage. Always obtain multiple quotes and read the fine print, as this simple step can save you money and ensure you're getting the best deal possible.

Another critical mistake to avoid is misunderstanding your coverage needs. Many people choose policies based on price alone, neglecting to assess their specific situation and risks. Take the time to evaluate factors such as your lifestyle, assets, and liabilities. Remember, the cheapest policy may not provide the coverage you require. It's essential to prioritize your coverage needs rather than simply opting for the lowest premium, as this could cost you significantly in the long run.