CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Insurance Policies: The Overlooked Lifesaver in Your Financial Toolbox

Unlock financial security with insurance policies—your essential yet overlooked lifesaver! Discover why you need them now!

Understanding the Different Types of Insurance Policies: Your Guide to Financial Security

Understanding the different types of insurance policies is essential for maintaining your financial security and safeguarding your assets. Insurance can be broadly categorized into several types, each serving its unique purpose. The most common types include life insurance, which provides a monetary benefit to beneficiaries upon the policyholder's death; health insurance, which covers medical expenses; and auto insurance, which protects against financial loss in case of vehicle accidents. Additionally, homeowners insurance offers protection for your home and personal belongings from damage or theft, while disability insurance ensures that you still receive income in case you cannot work due to a health issue.

Choosing the right combination of insurance policies can be overwhelming, but understanding each type can help streamline the decision-making process. It is advisable to assess your personal circumstances, risk tolerance, and financial goals before making a choice. You may also consider various factors such as coverage limits, exclusions, and premiums in each policy. By consulting with a reputable insurance agent or financial advisor, you can tailor a comprehensive insurance strategy that fits your needs, ultimately leading to greater peace of mind and financial security.

How Insurance Policies Can Protect Your Assets: A Comprehensive Overview

Insurance policies serve as a vital safety net for protecting your assets against unforeseen events, such as natural disasters, accidents, or legal liabilities. By investing in the right insurance coverage, individuals and businesses can ensure financial stability and peace of mind. For example, homeowners insurance safeguards your property from damages caused by fire, theft, or storm-related incidents, while auto insurance protects your vehicle from accidents and liability claims. Moreover, liability insurance shields your personal and business assets from legal claims that could arise from various situations, effectively preserving your hard-earned wealth.

To fully comprehend the importance of insurance in asset protection, it is crucial to consider the various types of policies available. A comprehensive overview includes:

- Property Insurance: Covers physical assets like homes, vehicles, and business assets.

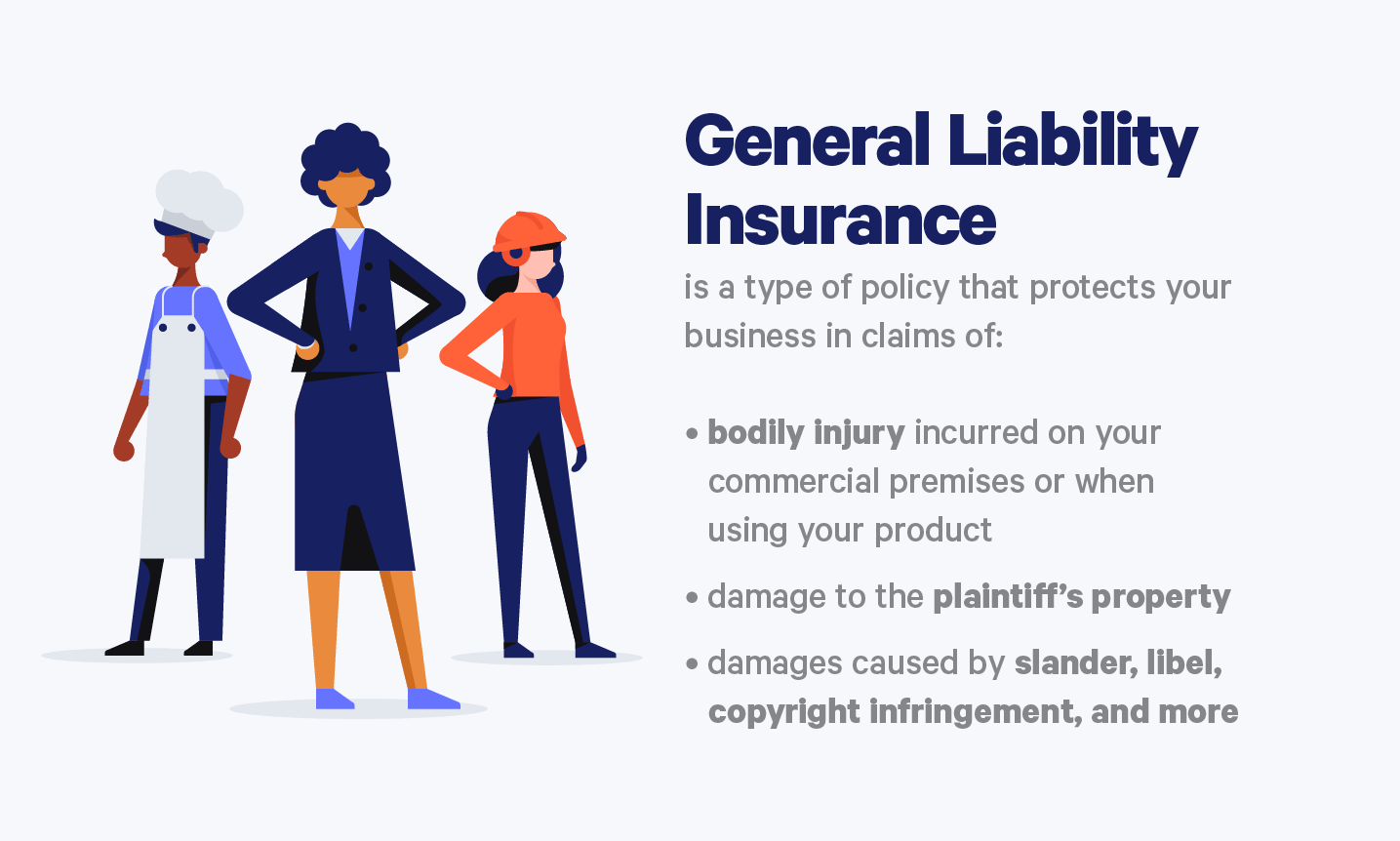

- Liability Insurance: Protects you from lawsuits for injuries or damages you may cause to others.

- Disability Insurance: Provides income replacement in the event of a disabling injury, ensuring you can maintain your lifestyle.

- Health Insurance: Covers medical expenses, preventing significant financial loss due to healthcare costs.

Are You Covered? 5 Essential Questions to Ask About Your Insurance Policies

When it comes to protecting your assets and loved ones, understanding your insurance policies is crucial. To ensure you're adequately covered, start by asking yourself these essential questions. What types of coverage do I need? This may include health, auto, home, or life insurance, depending on your personal situation. Additionally, consider how much coverage you need to effectively safeguard your financial future and manage risks. Assessing your needs is the first step in making informed decisions about your protection.

Next, inquire about deductibles and premiums. How much are you willing to pay out-of-pocket before coverage kicks in, and what monthly premium fits your budget? It's also important to confirm whether your policies include adequate liability coverage to protect against potential lawsuits. Finally, don’t hesitate to ask your insurance provider if there are any discounts available that can lower your costs. Gathering this information will help you make a well-informed decision about whether you are indeed covered.