CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Insurance on a Shoestring: Protecting What Matters Without Breaking the Bank

Discover affordable insurance tips that safeguard your essentials without draining your wallet. Protect what matters most today!

The Basics of Affordable Insurance: What You Need to Know

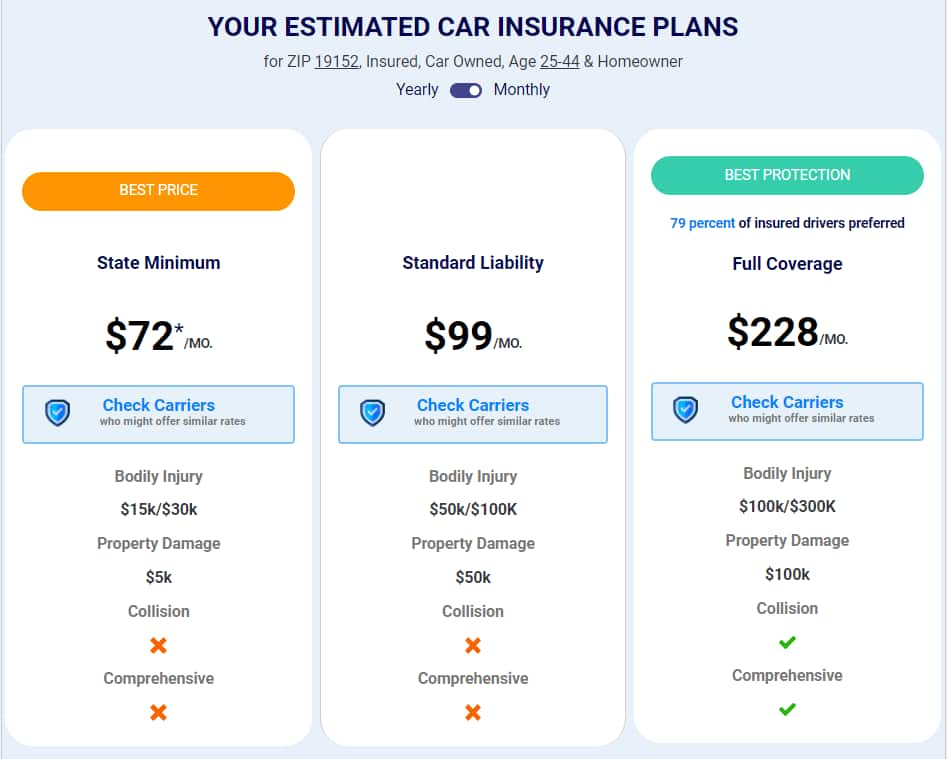

Understanding affordable insurance is crucial for making informed financial decisions. Whether you're seeking health, car, or home insurance, it’s important to compare different policies and their costs. Begin by evaluating your needs and budget; this will help you identify what types of coverage you require. Remember, affordable insurance doesn’t mean compromising on quality. You can start by obtaining quotes from multiple providers, researching their reputation, and reading customer reviews to ensure you're getting the best value for your money.

One common mistake many individuals make is solely focusing on the cheapest insurance options. Instead, prioritize the balance between cost and coverage. An effective way to find affordable insurance is to explore available discounts, such as bundling policies or actively participating in safe driving programs for car insurance. Additionally, consider increasing your deductible to lower your premiums, but ensure it remains manageable in case of an emergency. By taking these steps, you can secure a policy that meets your needs without breaking the bank.

Top 5 Budget-Friendly Insurance Options You Should Consider

When it comes to finding affordable protection, exploring budget-friendly insurance options can help you secure peace of mind without breaking the bank. Here are five options to consider:

- High-Deductible Health Plans (HDHPs) - These plans often come with lower premiums, allowing you to save on monthly payments while still having coverage for significant medical expenses.

- State-Sponsored Health Insurance - Many states offer low-cost or subsidized health insurance plans for individuals who meet specific income qualifications, providing vital coverage at a fraction of the cost.

- Pay-Per-Mile Car Insurance - If you drive infrequently, this option charges you based on the miles you drive, making it an economical choice for low-mileage drivers.

- Bundled Insurance Policies - Many insurers offer discounts on home and auto insurance when purchased together, which can help you save significantly.

- Consider Usage-Based Insurance - This innovative approach tailors your premiums based on actual driving behavior, often resulting in lower costs for safe drivers.

Choosing from these budget-friendly insurance options can significantly affect your financial well-being. Before making a decision, it's essential to assess your personal needs and closely compare available plans. Prioritize coverage that can provide the necessary protection while keeping your budget intact. Remember, it's not only about finding the cheapest option but also about ensuring you're adequately covered when it matters most.

How to Assess Your Insurance Needs Without Overspending

Assessing your insurance needs is crucial to ensure you have the right coverage without falling victim to overspending. Start by evaluating your assets and liabilities. Create a comprehensive list of what you own, including your home, car, and investments, and determine their current values. This will help you understand the level of coverage you need. Next, consider your lifestyle and any potential risks you face, such as having a family or owning a business. These factors will influence the types and amounts of insurance that are appropriate for your situation.

Once you've identified your coverage needs, it's time to compare insurance quotes from multiple providers. Take advantage of online comparison tools and consult with insurance agents who can tailor policies to your specific requirements. When examining quotes, pay attention to the deductibles and policy limits to ensure you're getting the best value for your money. Remember, it’s not just about the premium cost; you should also evaluate the reputation and service quality of the insurance company. This approach will help you make informed decisions without overspending on unnecessary coverage.