CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Insurance Coverage: The Safety Net You Didn't Know You Needed

Discover the hidden benefits of insurance coverage and why it’s the safety net you can’t afford to overlook!

What Types of Insurance Coverage Should You Consider for a Secure Future?

When planning for a secure future, it's crucial to consider a variety of insurance coverage options. Firstly, health insurance should be at the top of your list; it protects you from high medical costs. Additionally, you might want to explore life insurance, which provides financial security for your loved ones in case of unexpected events. Other vital types include disability insurance, ensuring that you have a source of income if you are unable to work due to a health issue, and homeowners or renters insurance, which safeguards your property and personal belongings.

Moreover, don't overlook auto insurance, especially if you own a vehicle; it covers damages and liabilities that arise from accidents. Liability insurance is also an essential coverage type, protecting you from potential legal costs arising from lawsuits. In summary, consider these crucial types of insurance to manage your risks effectively and build a more secure future:

- Health Insurance

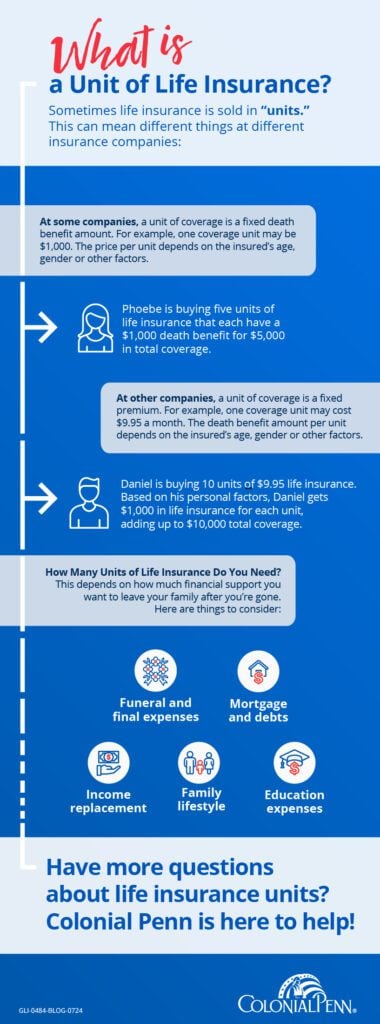

- Life Insurance

- Disability Insurance

- Homeowners/Renters Insurance

- Auto Insurance

- Liability Insurance

The Hidden Benefits of Insurance Coverage: How It Protects You Beyond the Basics

Insurance coverage often goes beyond simply protecting your assets during unexpected events. One of the hidden benefits of insurance is the peace of mind it provides. When you have comprehensive coverage, you can navigate daily life with confidence, knowing that you are safeguarded against potential financial slip-ups. For instance, having health insurance can significantly ease the burden of medical expenses, but it also ensures that you have access to quality healthcare without the added stress of costs. This allows you to focus on recovery rather than worrying about bills piled up during treatment.

Moreover, insurance can facilitate long-term financial stability. Many policies not only provide immediate protection but also include features like cash value accumulation or life insurance benefits. These aspects can serve as a financial cushion for you and your loved ones. In a way, insurance coverage acts as a safety net that prepares you for unforeseen challenges, whether they are health-related, property damage, or even liability claims. By recognizing these hidden benefits, you can make more informed choices about your insurance policies and enjoy a safeguard that supports you well into the future.

Is Your Insurance Coverage Enough? Essential Questions to Ask Yourself

When evaluating your insurance coverage, it's crucial to ask yourself if it truly meets your needs. Begin by considering the types of insurance you have in place—health, auto, home, and life insurance are just a few examples. Reflect on whether the coverage limits are sufficient to protect your assets or health in case of an emergency. For instance, do you have adequate coverage for unexpected medical expenses, or are your auto insurance limits too low to cover potential damages in an accident? Analyzing these factors will help you recognize any gaps in your protection.

Next, think about your changing circumstances that might necessitate adjustments in your insurance coverage. Have you recently experienced major life events such as marriage, the birth of a child, or a home purchase? Each of these situations can significantly impact your insurance needs. It's also wise to assess if you have built up enough savings or other resources to cover deductibles and out-of-pocket costs. To help you determine if your current coverage is adequate, consider asking yourself the following questions:

- What risks are most relevant to my current lifestyle?

- Are there any new assets that require coverage?

- How often do I review my insurance policies?