CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Dollars to Donuts: Discover Hidden Auto Insurance Discounts

Uncover secret auto insurance discounts! Save big on your premiums and discover how to get more for less with Dollars to Donuts.

Top 10 Hidden Discounts Auto Insurance Companies Don’t Want You to Know

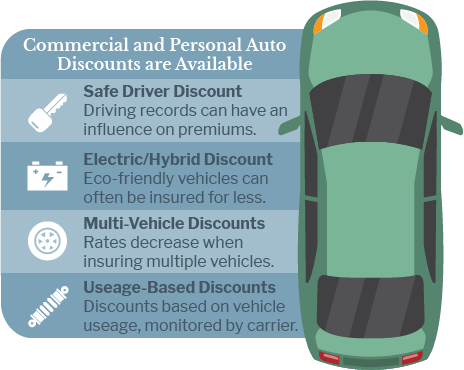

Finding the best auto insurance can feel like a daunting task, especially when trying to navigate through the numerous options available. However, many drivers are unaware of the hidden discounts offered by auto insurance companies that can significantly lower their premiums. Here, we uncover the top 10 hidden discounts that insurers often keep under wraps, ensuring you have the knowledge to save money on your car insurance. From safe driver discounts to multi-policy bundling, these savings could be yours if you just know where to look.

One of the most overlooked ways to reduce your auto insurance costs is through driver education discounts. If you have recently taken a defensive driving course, you might qualify for a reduction in your premium. Furthermore, many insurance providers offer discounts for good grades if you’re a student maintaining a B average or higher. Lastly, consider asking about low mileage discounts if you don’t drive frequently. These hidden gems are perfectly designed to reward responsible driving habits and can lead to significant savings on your policy.

Are You Missing Out? How to Maximize Your Auto Insurance Discounts

Are you aware that you might be missing out on significant savings when it comes to your auto insurance? Many drivers overlook various discounts that can substantially lower their premiums. Insurers often offer reductions for factors such as safe driving records, multi-policy bundling, and even for completing defensive driving courses. To maximize your auto insurance discounts, it's essential to regularly review the terms of your policy and ask your provider about any potential discounts that may apply to you. For instance, do you qualify for discounts for being a good student or maintaining a low mileage? These are just a few examples that could lead to substantial savings.

Furthermore, taking the time to shop around for quotes can make a big difference in finding the best deal. Maximizing your auto insurance discounts is not just about relying on your current provider; it also means comparing offers from different insurers. Consider using online tools and calculators that can help you assess your options. Also, don't hesitate to negotiate! Many companies are willing to adjust their rates or offer additional discounts to retain customers. Remember, the more informed you are about your options, the better positioned you'll be to secure the most cost-effective coverage while ensuring you're adequately protected on the road.

The Ultimate Guide to Uncovering Auto Insurance Savings

Finding the best auto insurance savings requires a strategic approach to navigate the multitude of options available. Start by comparing quotes from various providers. Use online comparison tools or visit insurance company websites to gather quotes tailored to your needs. Bundling your policies can also lead to significant savings, as many insurers offer discounts for customers who hold multiple policies, such as home and auto insurance. Additionally, consider increasing your deductible; while this means you'll pay more out-of-pocket in the event of a claim, it can substantially lower your premium.

Don't forget to leverage possible discounts offered by insurance companies. Many insurers provide discounts for safe driving, completing a defensive driving course, or maintaining a good credit score. It’s worth contacting your insurer to inquire about any potential savings that might apply to you. Regularly reviewing your coverage is essential as well; life changes like moving, changing jobs, or getting married can all impact your insurance needs. By keeping your coverage aligned with your current lifestyle, you can maximize your savings and ensure you only pay for the coverage you truly need.