CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Dollars Off Without the Drama: Scoring Auto Insurance Discounts

Unlock hidden auto insurance discounts and save big! Discover easy tips to score dollars off without the drama. Start saving today!

Unlocking Hidden Auto Insurance Discounts: Tips and Tricks

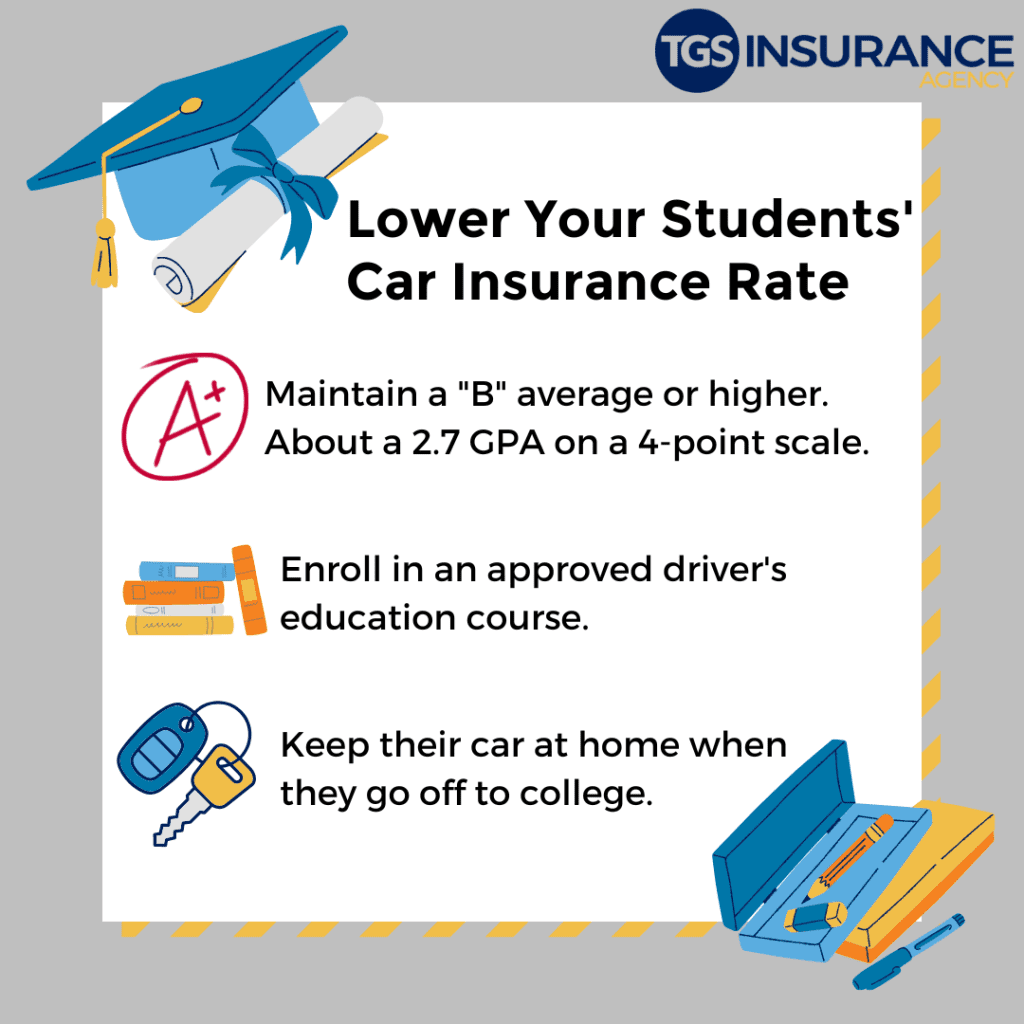

Auto insurance can often feel overwhelming, especially when it comes to managing costs. However, many policyholders overlook hidden auto insurance discounts that can significantly lower their premiums. One straightforward way to unlock these discounts is by asking your insurance provider about available savings. Many companies offer discounts for safe driving records, multi-policy bundling, and even for completing defensive driving courses. Don’t hesitate to inquire directly about specific criteria that could make you eligible for lower rates.

In addition to standard discounts, there are several lesser-known ways to save on your auto insurance. Consider checking for professional or organizational discounts based on your job or affiliations; some insurers offer reduced rates for members of certain organizations. Furthermore, exploring telematics programs—which assess driving habits through smartphone apps or devices—can also lead to potential savings for safe drivers. By leveraging these tips and tricks, you can discover numerous hidden auto insurance discounts that may be waiting just for you.

How to Maximize Your Auto Insurance Savings: A Step-by-Step Guide

Maximizing your auto insurance savings starts with understanding your coverage options. Begin by reviewing your current policy to identify areas where you might be overspending. It's essential to assess whether you need comprehensive coverage, collision protection, or liability insurance based on your vehicle's age and your driving habits. Consider increasing your deductible; this can significantly lower your premium. Additionally, taking advantage of available discounts, such as safe driver discounts or bundling policies, can yield substantial savings.

Once you’ve optimized your policy, it's time to shop around for quotes. Utilize comparison tools to gather multiple estimates from various insurers. When reviewing quotes, pay attention not only to the premium amounts but also to the coverage limits and deductibles. If necessary, consult with an insurance agent who can guide you in selecting a plan tailored to your needs. Finally, remember to reevaluate your coverage annually or after significant life changes—like moving or purchasing a new vehicle—to ensure you’re always getting the best rates possible.

What Factors Influence Your Auto Insurance Discounts?

When it comes to auto insurance discounts, several key factors play a significant role in determining how much you can save. Insurance providers typically assess your driving record, which includes factors such as the number of accidents and traffic violations you have incurred. A clean driving history often leads to lower rates, while a record filled with incidents may increase your premiums and eliminate potential discounts. Additionally, your credit score can impact your rates, as many insurers consider individuals with better credit profiles to be lower risk.

Another important factor is the type of vehicle you drive. Insurers often offer discounts for cars that are equipped with safety features or have a high safety rating. For example, vehicles with anti-lock brakes, airbags, and advanced security systems may qualify for additional savings. Furthermore, your approach to policy bundling can influence your discounts. Many companies provide better rates if you combine your auto insurance with other types of coverage, such as home or renter's insurance, allowing you to maximize your savings.