CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Cyber Liability Insurance: Your Business's Best Defense Against Digital Disasters

Protect your business from digital disasters with cyber liability insurance—your ultimate defense against costly data breaches!

Understanding Cyber Liability Insurance: Key Benefits for Your Business

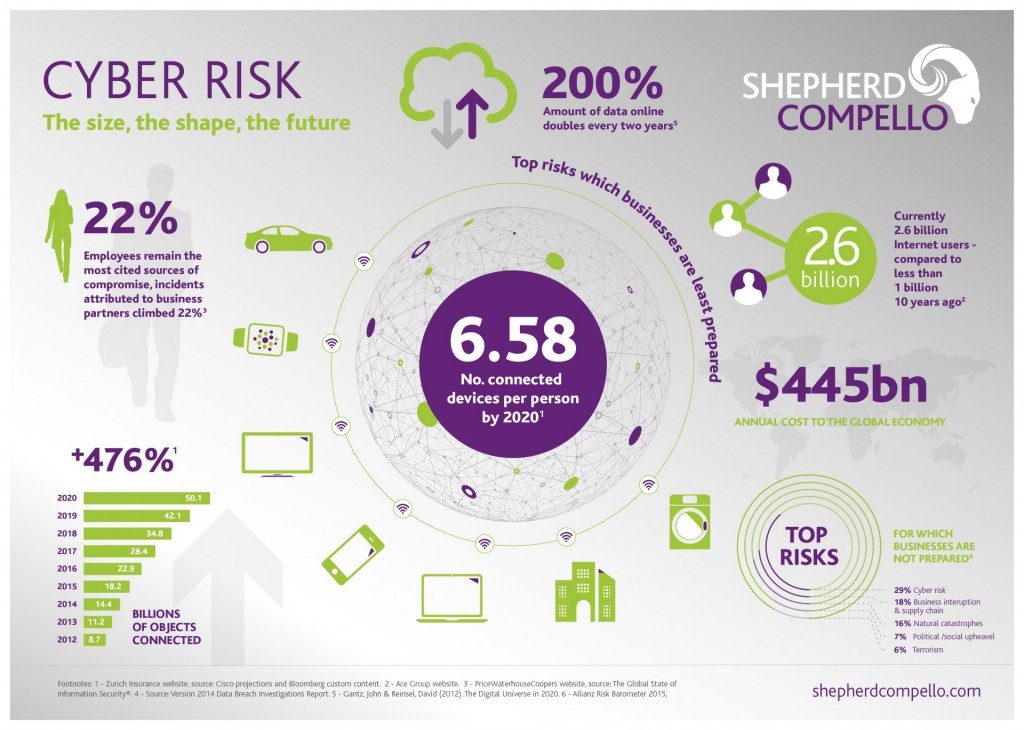

Cyber liability insurance is an essential risk management tool for businesses of all sizes in today’s digital world. As cyber threats continue to evolve, having this insurance can be crucial for protecting your company from significant financial losses associated with data breaches, hacking incidents, and other cyber-related risks. By securing cyber liability insurance, businesses can safeguard themselves against the costs of data recovery, legal fees, and customer notification, helping to ensure continuity despite unforeseen digital disruptions.

One of the key benefits of cyber liability insurance is that it not only covers financial losses but also provides access to critical resources. Most policies include support from cybersecurity experts who can help mitigate breaches swiftly and effectively. Additionally, cyber liability insurance typically includes coverage for public relations efforts, which can be vital in managing your business's reputation post-incident. In a landscape where consumer trust is paramount, investing in cyber liability insurance can provide peace of mind and foster confidence among your clients and stakeholders.

Top 5 Cyber Threats Every Business Should Protect Against

In today's digital landscape, businesses of all sizes are increasingly vulnerable to a variety of cyber threats. Understanding these risks is crucial for safeguarding sensitive data and maintaining operational integrity. The top five cyber threats that every business should prioritize include:

- Phishing Attacks - These deceptive emails trick employees into revealing confidential information or downloading malicious software.

- Ransomware - This form of malware encrypts critical files, rendering them inaccessible until a ransom is paid, severely impacting business continuity.

- Insider Threats - Current or former employees might exploit their access to sensitive systems to steal data or sabotage operations.

- Distributed Denial of Service (DDoS) Attacks - These attacks overwhelm servers with traffic, causing downtime and lost revenue.

- Data Breaches - Unauthorized access to sensitive data can result in significant financial and reputational damage.

To combat these cyber threats, businesses must adopt a proactive security strategy that involves employee training, up-to-date software, and robust data protection measures. Regular assessments of potential vulnerabilities and implementing strong computer policies can significantly reduce the risk of falling victim to these cyber attacks. By prioritizing cybersecurity, organizations not only protect their assets but also foster trust with clients and stakeholders, thereby ensuring long-term success in a digitally-driven world.

Is Your Business at Risk? Signs You Need Cyber Liability Insurance

In today's digitally connected world, businesses of all sizes face increasing threats from cyberattacks, data breaches, and other online vulnerabilities. Cyber liability insurance is designed to protect organizations from these risks, but how do you know if your business is truly at risk? Look for the following signs:

- Your business processes sensitive information, such as customer data, credit card details, or proprietary technology.

- You rely heavily on online transactions or digital platforms for your operations.

- Your industry has strict regulatory requirements regarding data protection and privacy.

Another clear indicator that your business might need cyber liability insurance is a lack of employee training regarding cybersecurity best practices. If your employees are unaware of phishing scams or how to secure sensitive information, your business is at a heightened risk for a breach. Additionally, if you’ve experienced any previous security incidents, be it small or large, it underscores the need for protection. Protecting your business isn’t just about having the right technology in place; having a solid insurance policy is equally critical in minimizing financial loss and ensuring a swift recovery in the event of a cyber incident.