CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Bargain Hunting for Protection: Finding Cheap Insurance Without Compromise

Unlock unbeatable savings on insurance! Discover how to find affordable coverage without sacrificing essential protection. Start saving today!

Top Strategies for Scoring Affordable Insurance Without Sacrificing Coverage

Finding affordable insurance without compromising on coverage can be a daunting task, but with the right strategies, it is entirely achievable. Start by comparing quotes from multiple providers to ensure you're getting the best deal. Utilize online comparison tools that allow you to input your needs and preferences, and receive personalized quotes that highlight your options. Additionally, consider bundling your insurance policies, such as combining home and auto insurance. Many companies offer discounts for bundled policies, which can lead to significant savings while maintaining adequate coverage.

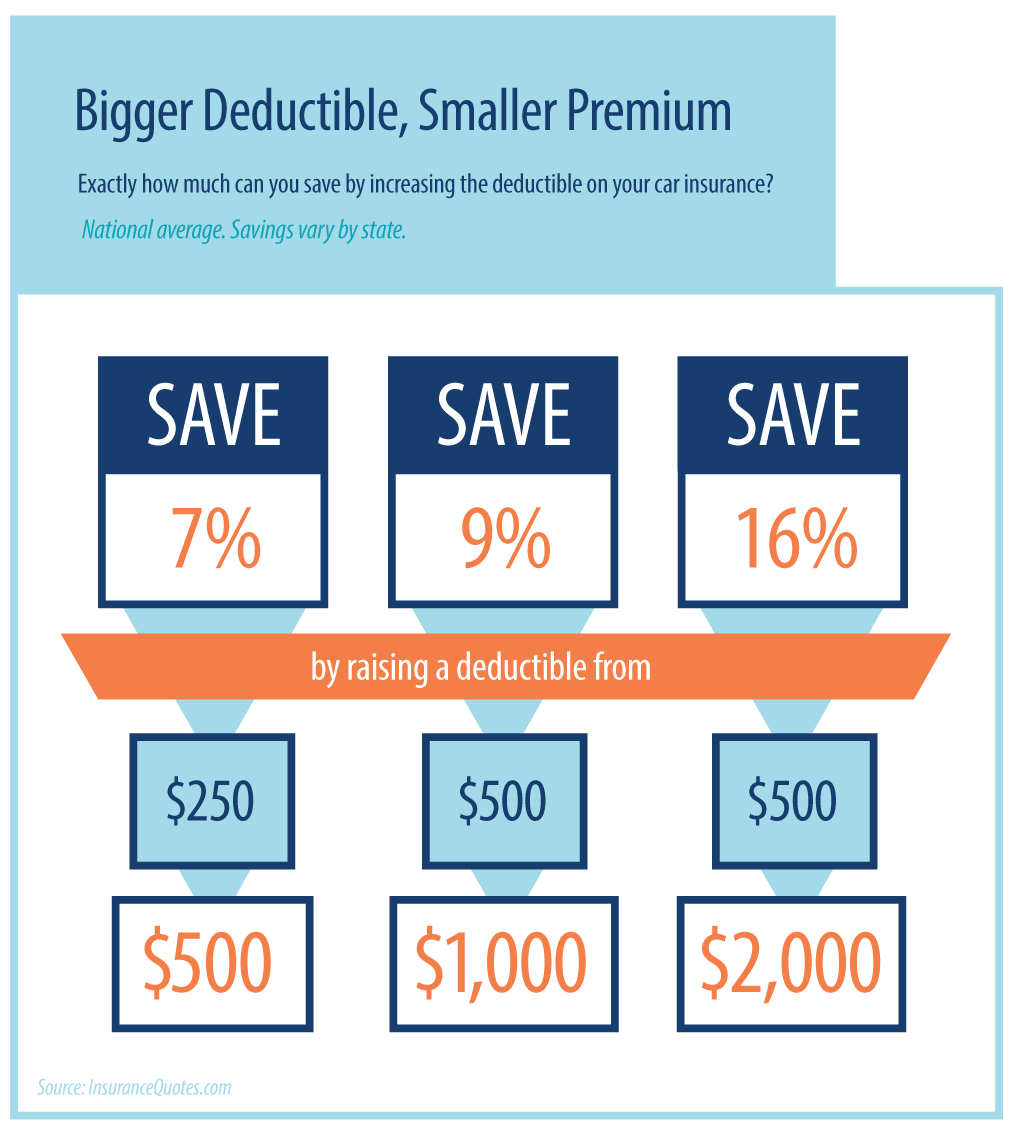

Another effective strategy is to thoroughly assess your coverage needs. Sometimes, people pay for coverage that they don't really need, which can inflate their premiums unnecessarily. For example, if your vehicle is older, you might consider dropping collision coverage to save money without sacrificing essential protection. Additionally, raising your deductible is a common practice that can lower your premium while you still enjoy comprehensive coverage when necessary. Always remember to review your policy annually and keep an eye out for any discounts you may be eligible for, such as safe driving, low mileage, or loyalty discounts.

5 Common Mistakes to Avoid When Shopping for Cheap Insurance

When it comes to finding affordable coverage, many consumers make common mistakes that can lead to poor decisions. One of the most significant errors is failing to compare quotes. Without examining multiple policies from various providers, shoppers may miss out on better deals or benefits that are offered elsewhere. Additionally, be cautious about simply choosing the cheapest option; it may not provide the necessary coverage you require. It's essential to consider both price and the quality of the policy to avoid regret later on.

Another frequent mistake is neglecting to read the fine print. Many cheap insurance policies come with hidden exclusions or limits that can leave policyholders vulnerable in the event of a claim. To avoid this pitfall, always take the time to review the terms and conditions of any policy thoroughly. Additionally, consumers often overlook the importance of checking the insurance company’s customer reviews. A low premium means little if the company's service is subpar or if they have a history of denying claims. By avoiding these mistakes, you can secure the best possible insurance for your needs.

Is Cheap Insurance Worth It? Assessing Value vs. Cost

When considering the question of cheap insurance, it's essential to balance the value you receive against the cost you incur. While opting for lower premiums may seem attractive, it often comes with trade-offs. For instance, cheap insurance policies might offer limited coverage, high deductibles, or inadequate customer service. To truly assess the worth of a cheap plan, it's crucial to analyze what is included in the policy and whether it meets your specific needs. When evaluating these options, consider the following criteria:

- Coverage Limits

- Deductibles

- Exclusions

- Customer Reviews

Ultimately, cheap insurance may save you money initially, but if it doesn’t provide sufficient coverage when it matters most, it can lead to significant out-of-pocket expenses down the line. It's important to conduct a thorough comparison of available policies, weighing factors like claims handling and additional financial protections. Remember, sometimes the most affordable option may not offer the best value, so investing a little more in a comprehensive policy might safeguard your financial future in ways that a cheaper option cannot. Always prioritize long-term benefits over short-term savings.