CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Savings on Wheels: Score Big with Auto Insurance Discounts

Unlock huge savings on auto insurance! Discover top tips and discounts to keep more cash in your pocket. Drive smart, save big!

Understanding Auto Insurance Discounts: What You Need to Know

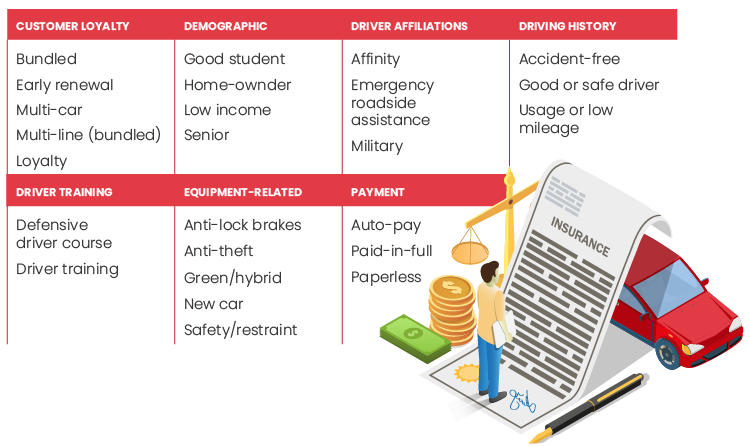

Understanding auto insurance discounts can help you save significantly on your premiums. Insurance providers offer a variety of discounts that cater to different drivers and circumstances. Common discounts include those for safe driving records, bundling policies, and completing defensive driving courses. By taking the time to research and inquire about these options, you can uncover opportunities to lower your costs without sacrificing coverage.

It's also important to note that auto insurance discounts can vary between companies and policies. For instance, some insurers may offer discounts for low mileage, while others provide savings for being a student with good grades. To ensure you're getting the best deal, consider comparing quotes from multiple providers and asking about all available discounts. Remember, every little bit counts when it comes to reducing your auto insurance expenses!

Top Tips to Maximize Your Auto Insurance Savings

When it comes to maximizing your auto insurance savings, starting with a comprehensive comparison of insurance quotes is essential. Use online tools to generate quotes from multiple providers, allowing you to see the differences in coverage and premiums. Bundling your policies can also lead to substantial discounts. For instance, if you have home or renters insurance, combining these with your auto policy often yields savings that can significantly reduce your overall insurance costs.

Another effective strategy to save on auto insurance is to maintain a clean driving record. Safe driving habits not only protect you on the road but also may qualify you for discounts based on your good driving history. It’s also wise to regularly review your coverage; as your vehicle ages, you may no longer need certain coverages. Consider adjusting your deductible as well; a higher deductible can lower your premium, but make sure it fits your financial situation. By implementing these tips, you can effectively manage and maximize your auto insurance savings.

Are You Missing Out on These Auto Insurance Discounts?

Many drivers are unaware that they could be saving a significant amount on their auto insurance premiums just by taking advantage of various auto insurance discounts. From bundling policies with the same insurer to taking a defensive driving course, there are a multitude of options available. For instance, insuring multiple vehicles under the same policy often results in substantial savings. Additionally, some companies offer discounts for policyholders who maintain a good credit score or have a clean driving record. These are just a few examples of how you might be missing out on potential savings that can add up over time.

It's essential to regularly review your auto insurance policy and ask your provider about any potential discounts you may qualify for. Many insurers offer discounts based on factors such as being a student, having low mileage, or even certain affiliations with professional organizations. For instance, seniors might benefit from discounts specifically designed for older drivers. Don't hesitate to reach out to your agent and inquire about these opportunities; you might find that a simple chat could lead to a significant reduction in your premiums.