CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Cyber Liability Insurance: Your Business's Invisible Shield

Protect your business from cyber threats! Discover how cyber liability insurance serves as your invisible shield against online risks.

Understanding Cyber Liability Insurance: Essential Coverage for Modern Businesses

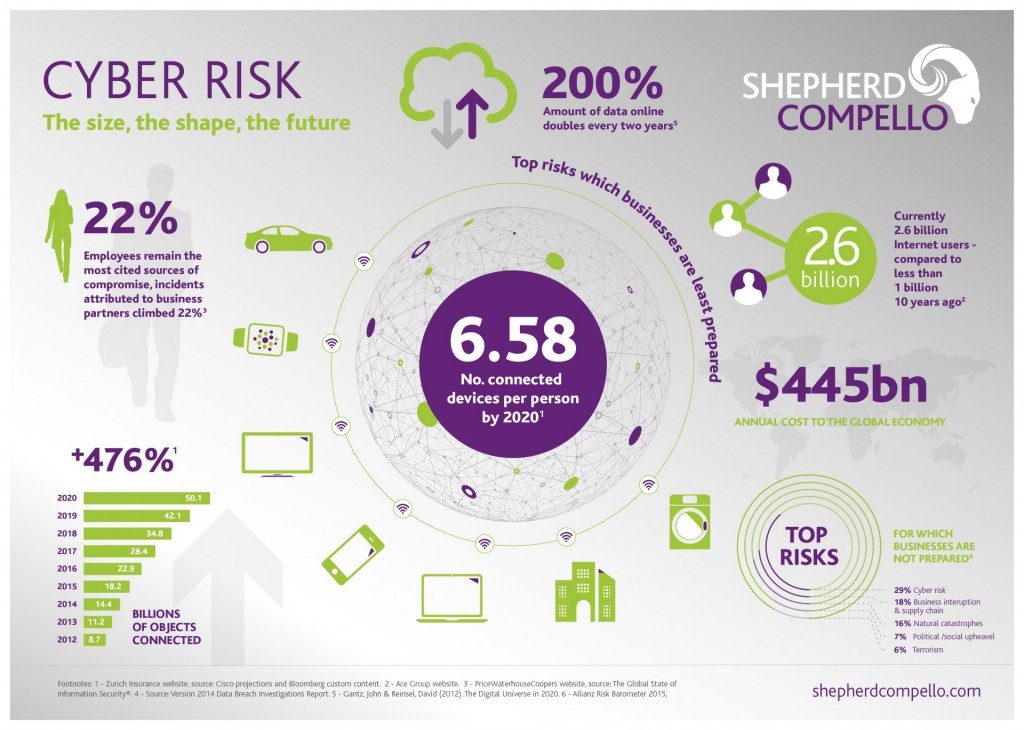

Understanding Cyber Liability Insurance is crucial for businesses operating in today's digital landscape. As organizations increasingly rely on technology and the internet, the risk of cyberattacks, data breaches, and other online threats has escalated dramatically. Cyber liability insurance serves as a safety net, providing financial protection against the costs associated with these incidents. It typically covers various expenses, including legal fees, notification costs for affected customers, and even regulatory fines. By investing in this essential coverage, businesses can mitigate potential losses and safeguard their reputation in case of a cyber event.

Moreover, modern businesses face a complex array of risks, and having a robust cyber liability insurance policy is more important than ever. This insurance not only protects against direct financial losses but can also provide valuable resources, such as access to cybersecurity professionals who can assist in crisis management and recovery. A comprehensive policy may include elements like data breach response services, identity theft protection for customers, and coverage for cyber extortion. Overall, understanding the nuances of cyber liability insurance helps businesses make informed decisions that enhance their resilience in an ever-evolving digital world.

5 Common Misconceptions About Cyber Liability Insurance Debunked

Cyber liability insurance is often misunderstood, leading to prevalent misconceptions among businesses regarding its purpose and coverage. One common myth is that it only protects against data breaches. In reality, cyber liability insurance offers a broader range of coverage that includes not just data breaches but also incidents like ransomware attacks, denial of service attacks, and even social engineering fraud. Many businesses fail to realize that their liability extends beyond just protecting their own data; they are also responsible for safeguarding the sensitive information of clients and partners, making a comprehensive policy essential.

Another misconception is that cyber liability insurance is too expensive for small businesses. However, as cyber attacks continue to rise, the cost of not having coverage can be far greater than the premiums. Many insurance providers offer tailored packages that can suit a range of budgets, ensuring that even small operations can protect themselves against significant financial losses. Additionally, awareness of the risks associated with cyber threats is growing, prompting insurers to create more accessible policies that cater to the unique needs of smaller enterprises.

Is Your Business at Risk? Key Questions to Ask About Cyber Liability Insurance

In today's digital landscape, cyber liability insurance has become essential for businesses of all sizes. As cyber threats evolve, it's crucial to assess whether your organization is adequately protected. To determine if your business is at risk, consider asking yourself the following questions: What types of data do we collect and store? and Have we experienced any security breaches in the past? Understanding the nature of your data and your previous vulnerabilities can highlight the importance of securing robust insurance coverage.

Furthermore, it's vital to evaluate your response plan in the event of a cyber incident. Ask yourself: Do we have a clear incident response plan? and How prepared are we to manage a data breach? A well-defined response strategy not only minimizes damage but can also influence your insurance premiums. Moreover, consider if your current policies address cyber liability explicitly, as many business insurance plans do not. By addressing these key questions, you can better understand your exposure and ensure that your business is not left unprotected in an increasingly connected world.