CSGO Flares: Your Ultimate Esports Hub

Explore the latest news, tips, and insights from the world of CS:GO.

Insurance Policies: The Safety Net You Didn't Know You Needed

Uncover the essential insurance policies you never knew you needed! Safeguard your future with the ultimate safety net—start reading now!

Understanding the Different Types of Insurance Policies: Which One is Right for You?

When navigating the world of insurance, it is crucial to understand the different types of insurance policies available to you. Each type serves a unique purpose and offers distinct benefits, ensuring that you can protect yourself, your family, or your business from unforeseen circumstances. Among the most common types are health insurance, which helps cover medical expenses; auto insurance, protecting against accidents and vehicle damage; and homeowner's insurance, safeguarding your property and possessions. To determine the right policy for you, consider factors such as your financial situation, family needs, and risk tolerance.

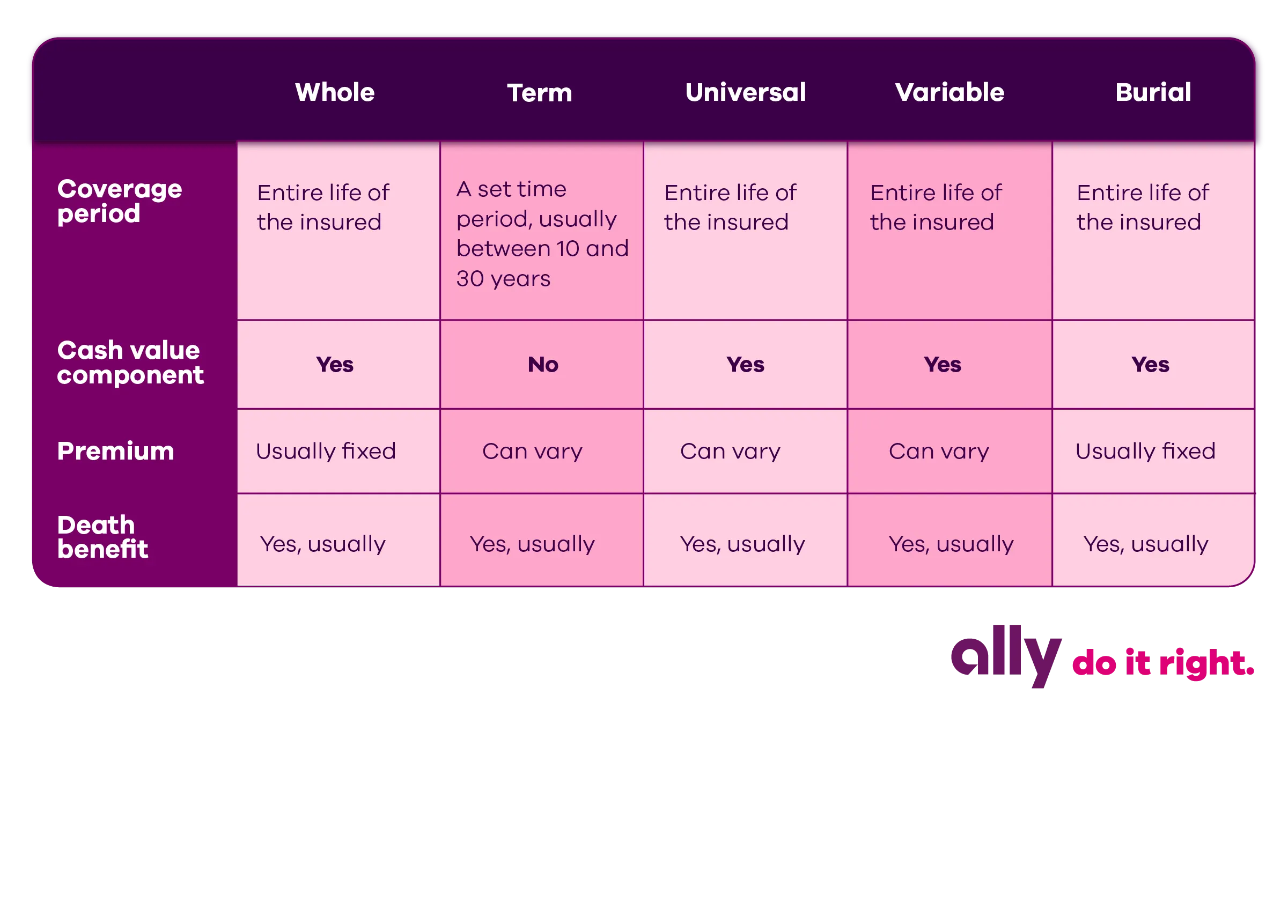

In addition to these primary insurance types, there are also specialized policies worth exploring, including life insurance, which provides financial security for your loved ones in the event of your passing, and disability insurance that replaces lost income due to unforeseen inability to work. To make an informed decision, assess your current obligations and future goals, along with the potential financial impact of unexpected events. By carefully evaluating your options and understanding the various policies available, you can confidently choose an insurance solution tailored to your unique needs.

Top 5 Myths About Insurance Policies Debunked

Insurance policies are often shrouded in misunderstanding, leading to the proliferation of myths that can negatively affect decision-making. One common myth is that all insurance policies are the same. In reality, different types of insurance serve distinct purposes and come with varying coverage options. For instance, life insurance and health insurance cater to different needs, and each policy may include unique stipulations and exclusions that ought to be reviewed carefully before purchasing.

Another prevalent myth is that cheaper insurance policies offer the same level of coverage as more expensive options. While it may be tempting to opt for a lower premium, budget insurance plans often skimp on crucial protections that could leave policyholders exposed to significant financial risks. Moreover, many believe that filing a claim will always lead to higher premiums; however, this isn’t always the case, as many insurers offer rewards for safe behavior, such as no-claims discounts. It's essential for consumers to understand the truth behind these common insurance myths to make informed choices.

How Insurance Policies Provide Financial Security in Uncertain Times

In an ever-changing world, insurance policies serve as a vital pillar of financial security, offering individuals and families peace of mind during uncertain times. Whether it’s health, auto, home, or life insurance, these policies are designed to protect against unexpected financial burdens that can arise from accidents, illnesses, or natural disasters. By paying a relatively small premium, policyholders can mitigate significant risks, ensuring that they are not left to bear the full brunt of unforeseen expenses. This risk management tool empowers people to navigate challenging circumstances with the assurance that they have a safety net in place.

Moreover, the role of insurance policies extends beyond just protection; they also facilitate long-term financial planning. Many policies include benefits such as cash value accumulation or dividends, which can provide additional funds when needed most. For example, whole life or universal life insurance can serve as a savings vehicle, offering policyholders access to funds during emergencies or opportunities. In summary, embracing insurance policies not only shields against immediate financial distress but also fosters greater financial stability and resilience in the face of life's uncertainties.